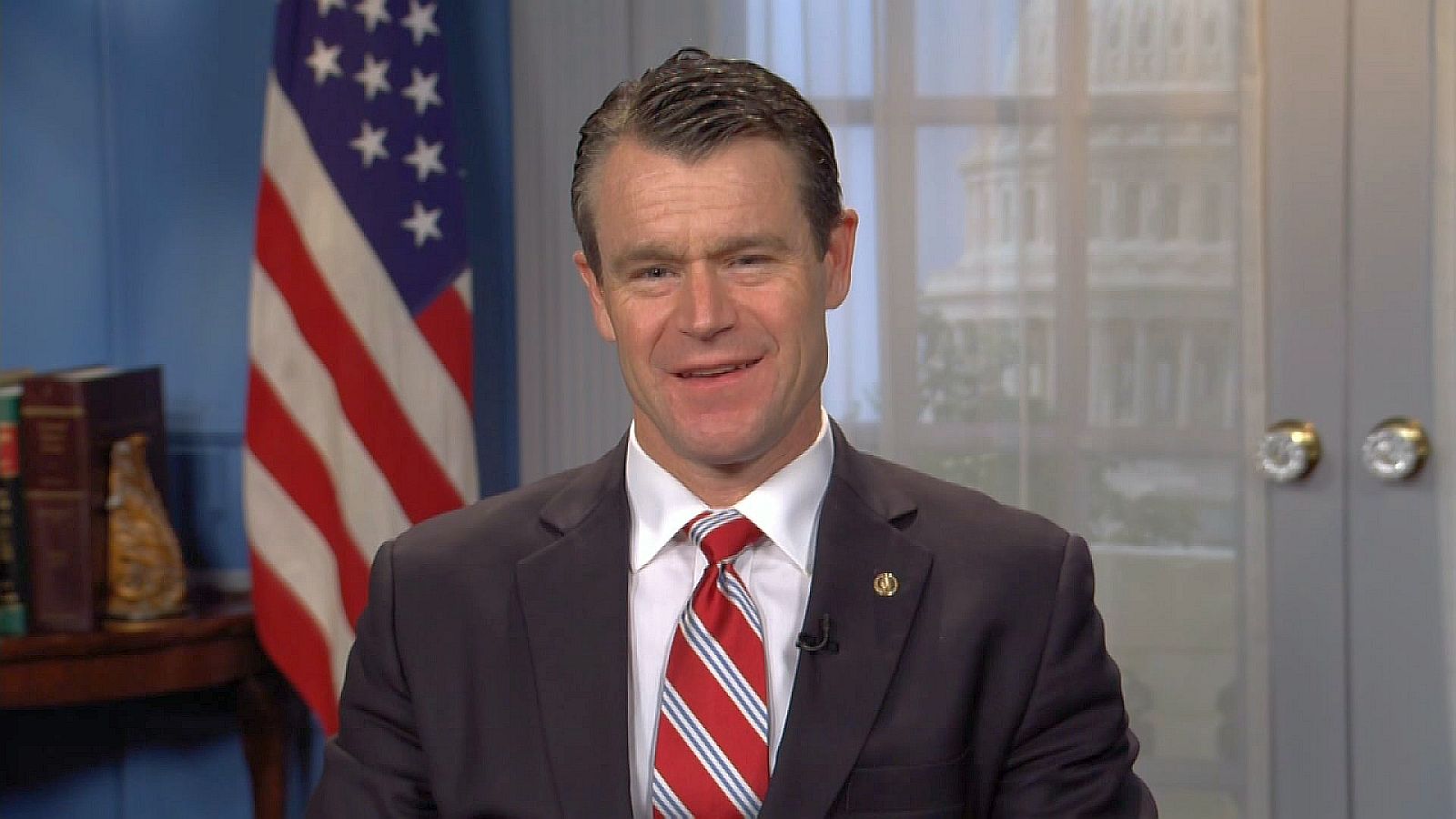

U.S. Senators Todd Young (R-Ind.) and Maggie Hassan (D-N.H.) reintroduced their bipartisan American Innovation and Jobs Act to support research and development (R&D) investments by innovative companies across Indiana and the United States.

Currently, businesses and startups investing in R&D can claim tax incentives that help them to invest in developing new, innovative products that lead to additional jobs and a stronger economy. The American Innovation and Jobs Act builds on this by expanding the refundable R&D tax credit and ensuring that businesses can once again fully deduct R&D expenses each year.

“Maintaining and encouraging R&D activities here in the United States is critical to providing high-quality jobs for Americans and ensuring our country remains competitive with our international rivals, most notably China,” said Senator Young. “Our American Innovation and Jobs Act would ensure businesses can fully deduct R&D expenses each year and expand the R&D tax credit for startups and small businesses. If we want to outcompete and out-innovate the Chinese Communist Party, we must pass this legislation as soon as possible.”

“When American companies invest in research and development to develop new products and technologies, it stimulates our economy, promotes job growth, and helps us compete with foreign adversaries,” said Senator Hassan. “I was proud to lead the effort to double the R&D tax credit for small businesses and startups in the Inflation Reduction Act, and am continuing the push with Senator Young to further expand these tax incentives. Our bipartisan bill will help more startups and businesses invest in research and development, and also ensure that they can fully deduct research and development expenses each year. I urge my colleagues on both sides of the aisle to support this bill that will spur innovation.”

The bipartisan American Innovation and Jobs Act supports innovative businesses and helps create jobs by:

Restoring incentives for long-term R&D investment by ensuring that companies can fully deduct R&D expenses each year Raising the cap over time for the refundable R&D tax credit for small businesses and startups Expanding eligibility for the refundable R&D tax credit so that more startups and new businesses can use itSenator Young has long supported investments in R&D. He introduced the American Innovation and Jobs Act in 2020 and 2021, and introduced a motion in 2022 to incentivize R&D investment in the United States, which passed the Senate by a vote of 90 to 5. In addition, Young led a bipartisan group of his colleagues in urging Senate leadership to expand the R&D tax credit and support U.S. economic competitiveness and innovation.

In addition to Senators Young and Hassan, Senators Cortez-Masto (D-Nev.), Barrasso (R-Wyo.), Sinema (I-Ariz.), Tillis (R-N.C.), Feinstein (D-Calif.), Daines (R-Mont.), Kelly (D-Ariz.), Hagerty (R-Tenn.), Murray (D-Wash.), Moran (R-Kan.), Peters (D-Mich.) and Wicker (R-Miss.) were also original cosponsors.

More about the bill can be found here.

Lisa's Little Free Library open in Sumner

Lisa's Little Free Library open in Sumner

Flood watch issued for southeastern Illinois

Flood watch issued for southeastern Illinois

Indiana earns top credit rating from major agency

Indiana earns top credit rating from major agency

LCMH to host Girls Night Out

LCMH to host Girls Night Out

Knox County extends road weight limits

Knox County extends road weight limits

BFPD announces officer promotions

BFPD announces officer promotions

Red Cross seeks donations to curb severe blood shortage

Red Cross seeks donations to curb severe blood shortage

IDPH releases carbon monoxide surveillance report, urges CO detector use

IDPH releases carbon monoxide surveillance report, urges CO detector use

Knox County Solid Waste looking for new Executive Director

Knox County Solid Waste looking for new Executive Director

Lawrence County authorities make three weekend arrests

Lawrence County authorities make three weekend arrests

Indians capture regional title

Indians capture regional title

Knox County Commissioners host public meeting on solar ordinance Sunday

Knox County Commissioners host public meeting on solar ordinance Sunday

IECC to hold SPIN nights

IECC to hold SPIN nights

INDOT Knox County bridge replacement project

INDOT Knox County bridge replacement project

Southwestern Indiana situation ends without incident

Southwestern Indiana situation ends without incident

INDOT implements new roadway worker safety initiative: Project Greenlight

INDOT implements new roadway worker safety initiative: Project Greenlight

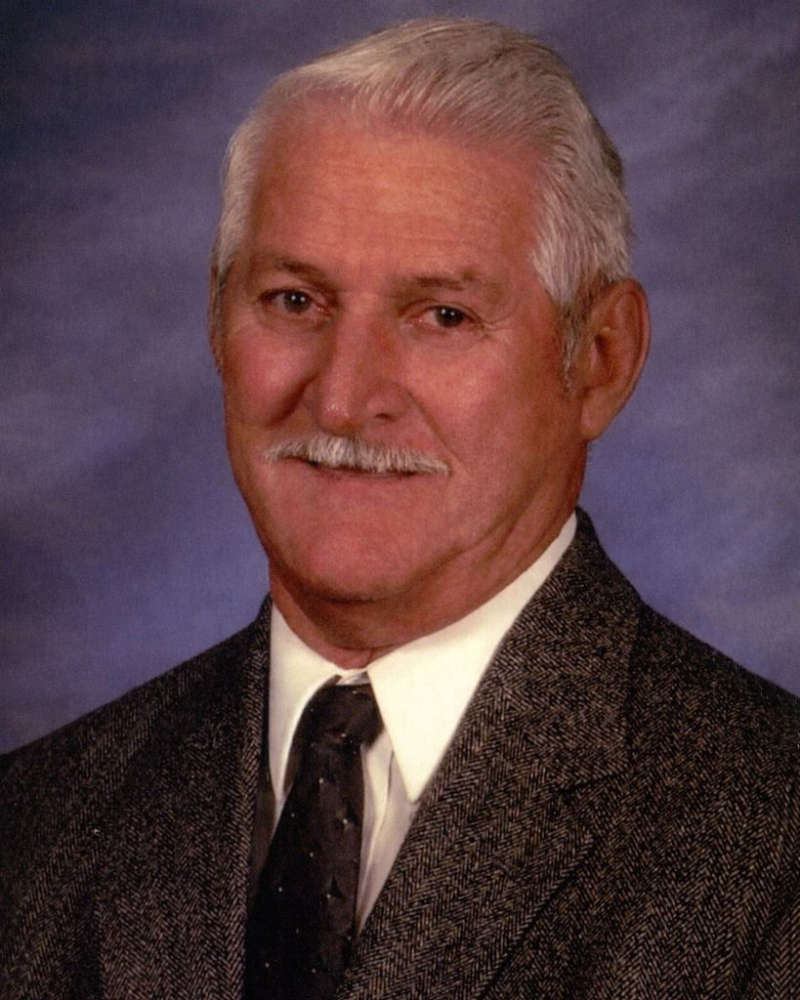

Metz receives ISBE Excel Award

Metz receives ISBE Excel Award