News

Monday evening the Plymouth Common Council accepted Tax Incremental Finance (TIF) Compliance Forms from three industries.

City Attorney jeff Houin told the council three companies, Farm Innovators, Riverside Commons and Complexus Medical each have real property tax abatements and Complexus Medical also has a personal property tax abatement.

Each year companies that have been granted a tax abatement from the City of Plymouth must submit annual compliance through a CF1 form. The form includes their expected investment and employment results as well as the assessed values. During the term of the abatement, they are required to file annually their current standings.

City Council members had no questions and motioned to approve the CF1 forms saying that each company showed substantial compliance with their projections.

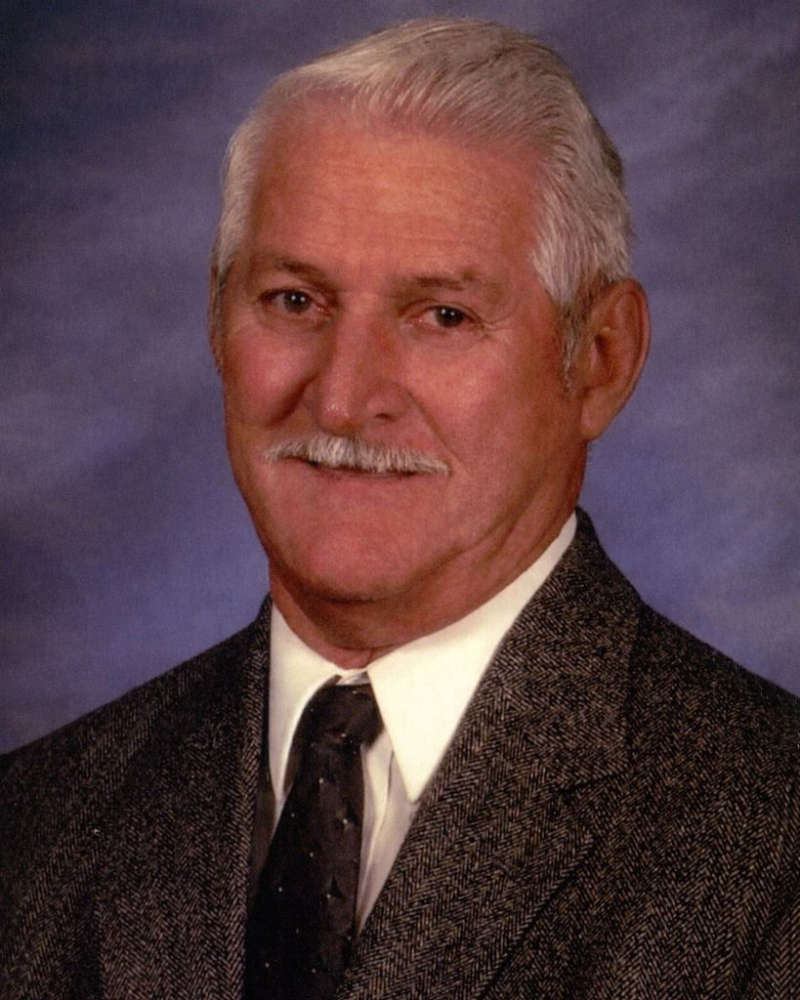

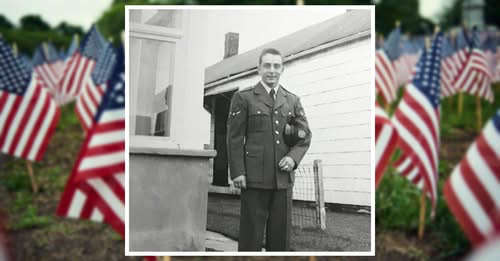

Edward Charles Ballinger, 65, Vincennes

Edward Charles Ballinger, 65, Vincennes

Rose named to Illinois Senate leadership team

Rose named to Illinois Senate leadership team

Embarrass River Flood Warning issued

Embarrass River Flood Warning issued

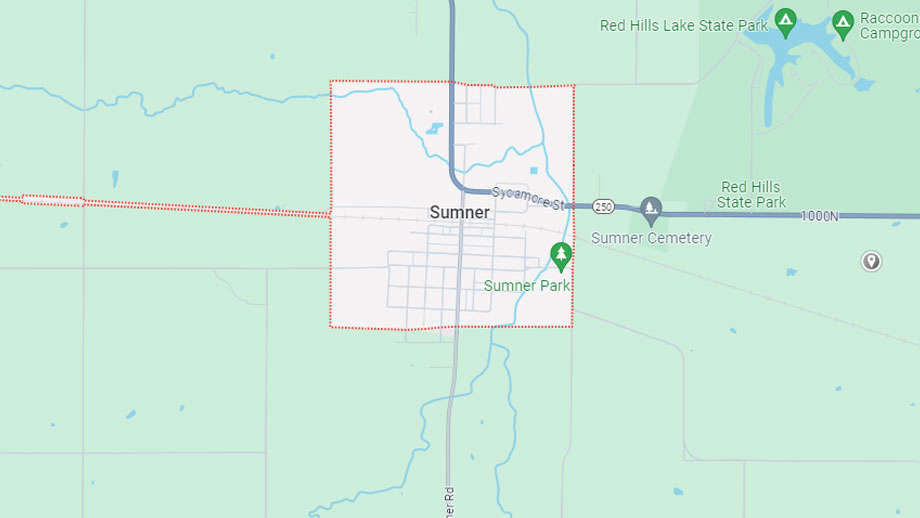

Lisa's Little Free Library open in Sumner

Lisa's Little Free Library open in Sumner

Indiana earns top credit rating from major agency

Indiana earns top credit rating from major agency

LCMH to host Girls Night Out

LCMH to host Girls Night Out

Knox County extends road weight limits

Knox County extends road weight limits

BFPD announces officer promotions

BFPD announces officer promotions

Red Cross seeks donations to curb severe blood shortage

Red Cross seeks donations to curb severe blood shortage

IDPH releases carbon monoxide surveillance report, urges CO detector use

IDPH releases carbon monoxide surveillance report, urges CO detector use

Knox County Solid Waste looking for new Executive Director

Knox County Solid Waste looking for new Executive Director

Lawrence County authorities make three weekend arrests

Lawrence County authorities make three weekend arrests

Indians capture regional title

Indians capture regional title

Knox County Commissioners host public meeting on solar ordinance Sunday

Knox County Commissioners host public meeting on solar ordinance Sunday

IECC to hold SPIN nights

IECC to hold SPIN nights

INDOT Knox County bridge replacement project

INDOT Knox County bridge replacement project