Marshall County Auditor Angie Birchmeier explained in the third article of the series an overview of the relationship between the auditor and the commissioners.

The fourth article in this series will explore the relationship between the county auditor and the county treasurer.

The treasurer, like the auditor, is a constitutional officer and the powers of the office are established by the Indiana Constitution. The treasurer is responsible for collecting property taxes semi-annually as well as managing the cash balances of the county. The auditor is responsible for the funds ledger and is the official record of the finances of the county.

The auditor’s office calculates the property tax statements annually as well as applies deductions and adds drainage assessments. Once calculated, the information is uploaded to the State Department of Local Government Finance (DLGF) and the State Comptroller for their review.

After approval, any mowing/weed/sewer liens or additional fees that need to be added to specific property tax parcels are added and mailing addresses are updated. Upon completion of those processes, the information is then sent to the treasurer’s office to apply any advance payments then process for printing and mailing no later than April 15 of each year with the first installment due May 10 and the second installment due Nov. 10 by statute.

The treasurer collects all the property taxes due and payable for each installment, then works with the auditor’s office for semi-annual settlement. The property taxes collected are for all units of local government within Marshall County per the budget order issued by the DLGF annually based on the submitted budgets and maximum levy (maximum amount of property tax) that can be collected. Once the treasurer certifies the collection for the spring or fall accordingly, the information is passed back to the auditors’ office to process.

Prior to settlement, which occurs each June and December, the treasurer holds the funds on their cashbook until the money is receipted into the funds in the auditor’s ledger. Unlike the daily receipts that are receipted into the fund and the cash deposited, the property taxes are collected, deposited and accounted for on the treasurer’s cashbook until settlement. During the settlement process, there is a receipt for the entire amount collected during that installment, which is receipted into the settlement fund, then disbursed to the local units of government as well as to the county levy funds.

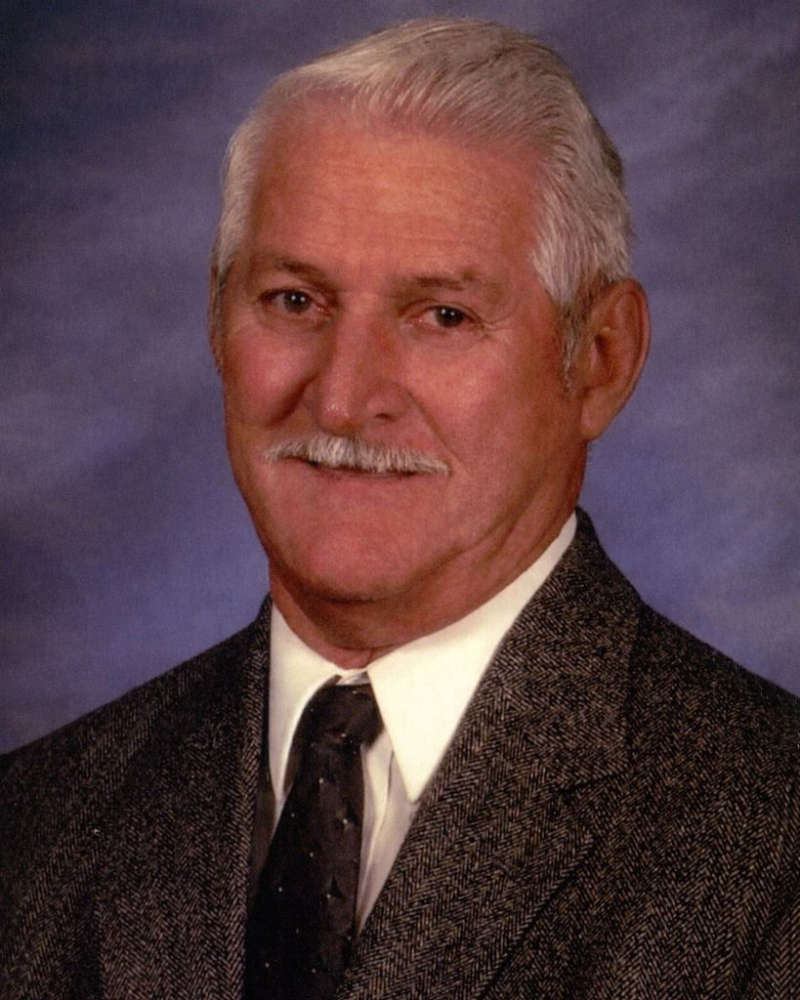

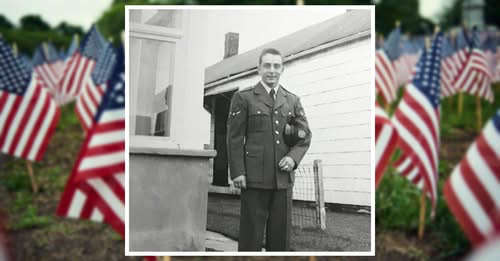

Edward Charles Ballinger, 65, Vincennes

Edward Charles Ballinger, 65, Vincennes

Rose named to Illinois Senate leadership team

Rose named to Illinois Senate leadership team

Embarrass River Flood Warning issued

Embarrass River Flood Warning issued

Lisa's Little Free Library open in Sumner

Lisa's Little Free Library open in Sumner

Indiana earns top credit rating from major agency

Indiana earns top credit rating from major agency

LCMH to host Girls Night Out

LCMH to host Girls Night Out

Knox County extends road weight limits

Knox County extends road weight limits

BFPD announces officer promotions

BFPD announces officer promotions

Red Cross seeks donations to curb severe blood shortage

Red Cross seeks donations to curb severe blood shortage

IDPH releases carbon monoxide surveillance report, urges CO detector use

IDPH releases carbon monoxide surveillance report, urges CO detector use

Knox County Solid Waste looking for new Executive Director

Knox County Solid Waste looking for new Executive Director

Lawrence County authorities make three weekend arrests

Lawrence County authorities make three weekend arrests

Indians capture regional title

Indians capture regional title

Knox County Commissioners host public meeting on solar ordinance Sunday

Knox County Commissioners host public meeting on solar ordinance Sunday

IECC to hold SPIN nights

IECC to hold SPIN nights

INDOT Knox County bridge replacement project

INDOT Knox County bridge replacement project