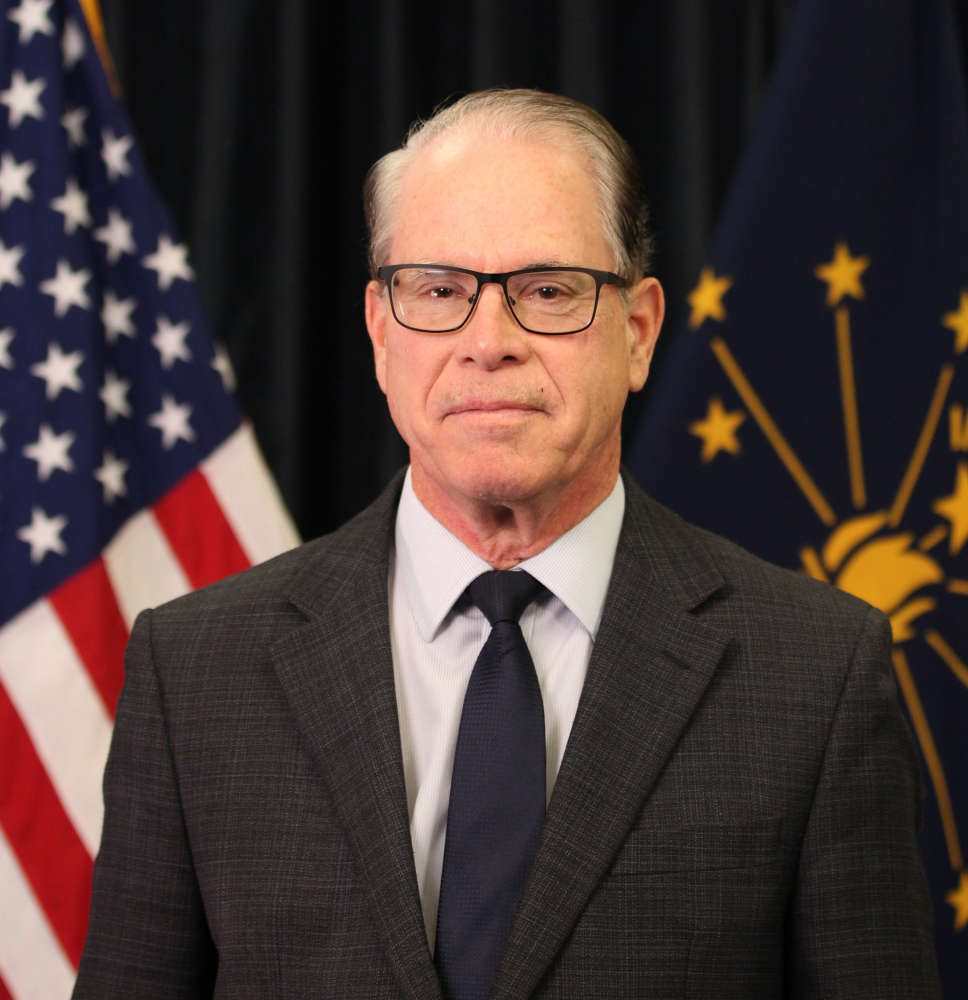

The Senate Committee on Tax and Fiscal Policy passed Senate Bill 1 today (2/11/25), advancing the bill to the Senate floor for consideration. The Governor's office issued the following statement.

"Governor Braun remains committed to delivering meaningful property tax reform that puts taxpayers first by providing immediate relief, capping future growth, and simplifying the process through reform and transparency. Today, the Senate Committee on Tax and Fiscal Policy has taken steps in the right direction by proposing strong caps on future bill growth, reforms to the referendum process, and targeted relief for veterans, retirees, and first-time homebuyers, but Hoosier homeowners need a solution that includes broad and immediate reductions in their tax bills.

"The Governor will carefully review the changes to his plan and looks forward to working with the House and Senate to strengthen the amended bill to include broad based and immediate property tax cuts for Hoosier homeowners who have been hit the hardest by skyrocketing home value inflation."

GSH approves 2026 budget

GSH approves 2026 budget

Sumner boil order ends, trash pickup delayed

Sumner boil order ends, trash pickup delayed

IDNR revises waterfowl zone

IDNR revises waterfowl zone

Two Lawrence County men charged

Two Lawrence County men charged

2026 Miss Illinois County Fair Pageant coming in January

2026 Miss Illinois County Fair Pageant coming in January

Unit #20 Board hears about heat and new athletic facility proposal

Unit #20 Board hears about heat and new athletic facility proposal

Indiana's state parks offer New Years Day events

Indiana's state parks offer New Years Day events

Parkview hosts annual school spelling bee

Parkview hosts annual school spelling bee

Crawford County man charged with sex crimes

Crawford County man charged with sex crimes

Voter registration underway in Lawrence County

Voter registration underway in Lawrence County

DNR receives regional award for project on former mine land near Pleasantville

DNR receives regional award for project on former mine land near Pleasantville

Unit #10 Board hosts project open house

Unit #10 Board hosts project open house

County to assist in Sumner street improvements

County to assist in Sumner street improvements

BMV announces Christmas and New Year's Day holiday hours

BMV announces Christmas and New Year's Day holiday hours

Bridgeport boil order lifted

Bridgeport boil order lifted

Gregg Park project to move forward

Gregg Park project to move forward

St. Francisville hires water engineer

St. Francisville hires water engineer