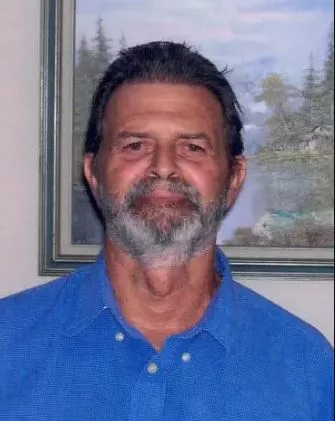

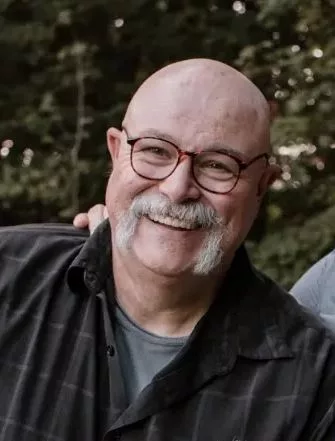

According to state reps. Jack Jordan (R-Bremen) and Jake Teshka (R-North Liberty), the 2025 legislative session ended with passage of the state's next two-year budget, tax relief, and other key priorities for Hoosiers.

"Faced with a tight budget, Indiana did exactly what families across our state have been doing. We cut spending while investing in our most important priorities, upholding our long-standing commitment to fiscal responsibility," said Jordan, chair of the House Ways and Means Committee's Budget Subcommittee. "We supported our students, children, and law enforcement, and lowered taxes for hardworking Hoosiers and families."

The budget accounts for lowering Indiana's state income tax each of the next two years, saving taxpayers over $200 million per year. The legislature also advanced significant property tax relief and reform legislation this session. These two tax cuts will save Hoosiers $1.3 billion in taxes over the next two years. Key investments were also made in K-12 education and public safety, including expanding Indiana's school choice scholarship program to all Hoosier families beginning next year.

"This was a productive legislative session that concluded with more government transparency and lower taxes for Hoosiers," Teshka said. "We also made significant gains to improve education, including reducing burdensome regulations on K-12 schools, advancing universal school choice so that all Hoosier students can attend the school that's best for them, and prioritizing math and STEM education."

All eight of the House Republican priority items advanced to the Governor's desk by the adjournment of session, including:

- House Enrolled Act 1001: Enacting an honestly balanced, two-year state budget that makes government more efficient, strengthens our commitment to education and public safety, and protects taxpayers.

- House Enrolled Act 1002: Reducing regulations on K-12 schools to increase flexibility and give local communities more control over education decisions.

- House Enrolled Act 1003: Lowering health care costs for Hoosiers by improving transparency and predictability in pricing and billing, and giving patients more control over their treatment options.

- House Enrolled Act 1004: Ensuring nonprofit hospitals act as nonprofit entities focused on delivering health care.

- House Enrolled Act 1005: Improving access to housing by expanding the Residential Housing Infrastructure Assistance Program (RIF) and streamlining the regulatory process for housing development.

- House Enrolled Act 1006: Strengthening public safety by creating a review board to investigate prosecutors who refuse to enforce our laws.

- House Enrolled Act 1007: Meeting the needs of today's energy economy while reducing costs for Hoosiers.

- House Enrolled Act 1008: Welcoming Illinois counties that have voted to secede from their state to join us in Indiana.

To learn more about these and other new laws signed by the governor, click here.

U.S. Rep. Yakym’s bipartisan BARCODE Efficiency Act Advances

U.S. Rep. Yakym’s bipartisan BARCODE Efficiency Act Advances

Applications available for Indiana Sheriffs' Association college scholarships

Applications available for Indiana Sheriffs' Association college scholarships

Parke County RDC closes on the purchase of the former Rockville National Bank Building

Parke County RDC closes on the purchase of the former Rockville National Bank Building

Deadline approaching for blind, disabled Hoosiers and seniors to receive property tax credits

Deadline approaching for blind, disabled Hoosiers and seniors to receive property tax credits

One Night, One Cause: Indiana FFA needs your support for their ‘Blue and Gold Gala’

One Night, One Cause: Indiana FFA needs your support for their ‘Blue and Gold Gala’

Gov. Braun secures National Drone Test Site Designation for Indiana

Gov. Braun secures National Drone Test Site Designation for Indiana

ISP with Human Trafficking Awareness Initiative this week

ISP with Human Trafficking Awareness Initiative this week

Rockville Town Board shuffles up leadership positions

Rockville Town Board shuffles up leadership positions

Political candidates can begin filing this week

Political candidates can begin filing this week

Historic sites bill passes out of committee

Historic sites bill passes out of committee

More than one-third of Christmas tree home fires occur in January

More than one-third of Christmas tree home fires occur in January

Temporary visitation restrictions enacted by Union Health due to uptick in respiratory virus cases

Temporary visitation restrictions enacted by Union Health due to uptick in respiratory virus cases

Reps. Heaton, Yocum: Indiana House accepting student applicants for 2026 page program

Reps. Heaton, Yocum: Indiana House accepting student applicants for 2026 page program

VCCF awards $2,500 grant to support Free Laundry Day Program

VCCF awards $2,500 grant to support Free Laundry Day Program