Governor Braun recently signed into law Senate Enrolled Act 1, delivering real property tax relief and long-term reforms for Hoosiers.

Click here for more details on SEA 1.

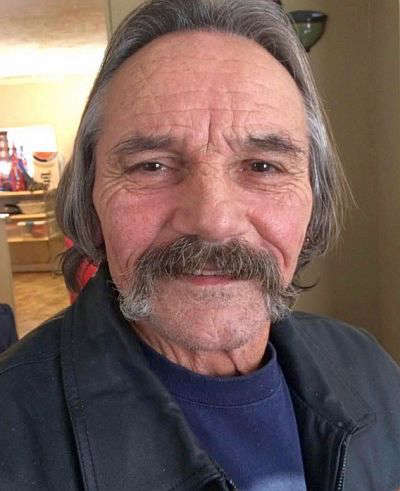

State Representative Jack Jordan explained what this will mean to his constituents:

- $1.3 billion in homeowner savings over the next three years

- Two-thirds of homeowners will pay less property tax in 2026 than in 2025

- Additional savings for fixed-income seniors, farmers, and Hoosier small businesses

Jordan said, “SEA 1 provides a 10% property tax credit, up to $300, for all homestead properties starting in 2026. Fixed-income seniors and disabled veterans will qualify for additional stackable credits of up to $550 total, bringing even more savings to those who need it most.”

Additionally, the law delivers more than $125 million in tax relief for farmers and exempts more Hoosier small businesses from business personal property taxes. It also reins in local government debt and reduces the total amount of local income tax that local government can capture, reducing the cap from 3.75% to 2.9%, a reduction of $1.9 billion in local taxes.

SEA 1 reforms the referendum process for more transparency and creates a new Property Tax Transparency Portal to give taxpayers better access to their tax data.

Jordan said, “This law is a big win for homeowners, farmers, seniors, and taxpayers across Indiana.”

To learn more and watch session and committee meetings, visit iga.in.gov.

ISP Commercial Vehicle Enforcement Division Statistics

ISP Commercial Vehicle Enforcement Division Statistics

IN Reps. Jordan & Teska to appear at Third House Wednesday with Senator Bohacek

IN Reps. Jordan & Teska to appear at Third House Wednesday with Senator Bohacek

Indiana is Open for Business: February’s Jobs and Wages Wins

Indiana is Open for Business: February’s Jobs and Wages Wins

Marshall County man sentenced to 11½ years for firearm possession, drug-related driving

Marshall County man sentenced to 11½ years for firearm possession, drug-related driving

Two Republican candidates removed from May Primary Ballot over voting requirements

Two Republican candidates removed from May Primary Ballot over voting requirements

Plymouth School Board meeting Tuesday evening at 6

Plymouth School Board meeting Tuesday evening at 6

Chicago woman arrested on drug charge after traffic stop

Chicago woman arrested on drug charge after traffic stop

Man killed in Fulton County hunting accident

Man killed in Fulton County hunting accident