A press release from Plymouth Mayor Robert Listenberger states that the Plymouth Common Council will be considering implementation of a wheel tax to ensure sustainable local road funding in light of Indiana House Bill 1461 and changes in state funding.

The mayor’s release says Plymouth’s streets are more than a convenience; they are essential for public safety, economic development, and quality of life.

Listenberger said, “Our ability to fund local street maintenance and improvement projects depends heavily on state support. The State of Indiana has historically returned tax dollars to local governments, helping to cover the costs of repairing potholes, resurfacing streets, replacing signage, and upgrading critical infrastructure. However, this model of state funding is changing, placing more responsibility on local jurisdictions like Plymouth to identify and secure their own street funding solutions.”

In 2025, the Indiana General Assembly passed House Bill 1461, a significant piece of legislation that altered the way transportation and infrastructure projects are funded throughout the state. The bill shifts a greater share of responsibility for street maintenance and improvements from the state level to cities and counties. Specifically, House Bill 1461 restructures the distribution formula for state highway funds, resulting in reduced allocations for many mid-sized and smaller communities such as Plymouth.

Under this new law, state contributions to local street projects have been recalibrated to focus more on regional priorities and high-traffic corridors, often at the expense of smaller cities and rural areas.

In addition, many municipalities will need to decide whether to pass a local wheel tax to continue receiving the most benefit from Community Crossings Matching Grants. Mayor Listenberger stated, “The immediate impact of House Bill 1461 on Plymouth is a projected shortfall of several hundred thousand dollars in our annual road maintenance budget.”

The proposed wheel tax would apply to vehicles registered in Plymouth, including passenger vehicles, trucks, motorcycles, and trailers. The revenue generated will be earmarked strictly for transportation infrastructure—by law, these funds cannot be diverted to other purposes. The tax rate will be carefully calibrated based on vehicle type and will be reviewed annually to ensure fairness and adequacy.

The mayor said, “Plymouth stands at a crossroads. The shift in state funding brought about by Indiana House Bill 1461 means that our community must take new steps to maintain and improve the streets we all rely on.”

He continued, “I urge all residents to stay informed and engaged as we move forward with this important decision. Working together, we can continue to build a brighter future for Plymouth.”

For questions or comments, contact Mayor Listenberger’s office at (574) 936-6717 or email at mayor@plymouthin.com

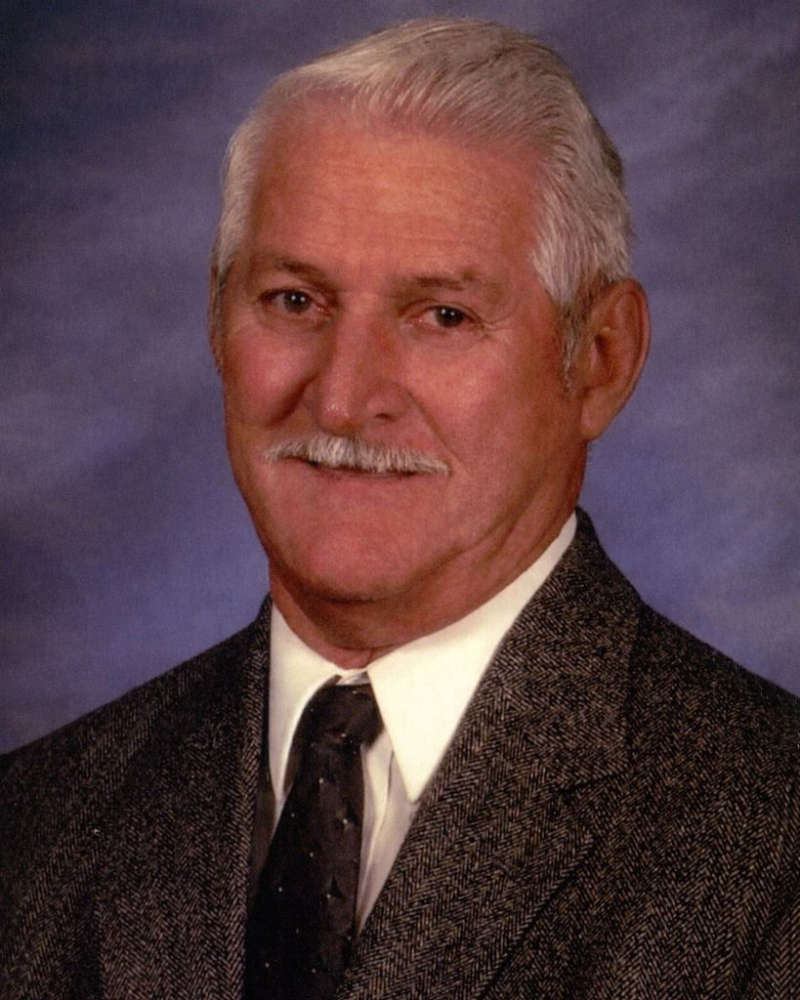

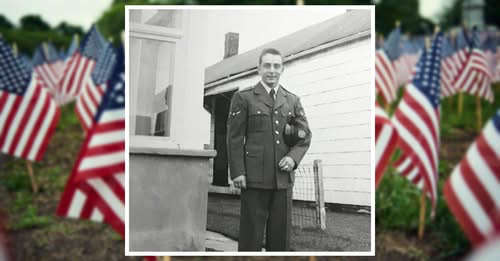

Edward Charles Ballinger, 65, Vincennes

Edward Charles Ballinger, 65, Vincennes

Rose named to Illinois Senate leadership team

Rose named to Illinois Senate leadership team

Embarrass River Flood Warning issued

Embarrass River Flood Warning issued

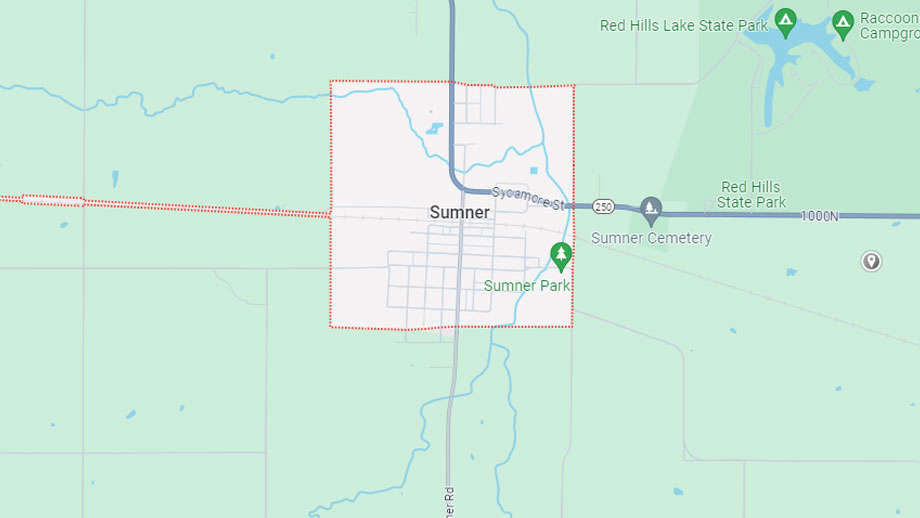

Lisa's Little Free Library open in Sumner

Lisa's Little Free Library open in Sumner

Indiana earns top credit rating from major agency

Indiana earns top credit rating from major agency

LCMH to host Girls Night Out

LCMH to host Girls Night Out

Knox County extends road weight limits

Knox County extends road weight limits

BFPD announces officer promotions

BFPD announces officer promotions

Red Cross seeks donations to curb severe blood shortage

Red Cross seeks donations to curb severe blood shortage

IDPH releases carbon monoxide surveillance report, urges CO detector use

IDPH releases carbon monoxide surveillance report, urges CO detector use

Knox County Solid Waste looking for new Executive Director

Knox County Solid Waste looking for new Executive Director

Lawrence County authorities make three weekend arrests

Lawrence County authorities make three weekend arrests

Indians capture regional title

Indians capture regional title

Knox County Commissioners host public meeting on solar ordinance Sunday

Knox County Commissioners host public meeting on solar ordinance Sunday

IECC to hold SPIN nights

IECC to hold SPIN nights

INDOT Knox County bridge replacement project

INDOT Knox County bridge replacement project