Small-business owners are among the hardest-working Hoosiers in our state, and State Senator Mike Bohacek said in a recent release, “I want to do my part in supporting them.”

The senator continued, “That's why I voted in favor of Senate Bill 2 last week, which would level the playing field to allow small businesses to qualify for the same federal tax deductions that larger corporations already receive.” This change could amount to $50 million in federal tax savings for Indiana businesses.

In 2021, Indiana set a record for the most business filings in a year at 94,670 and was recently named the No. 1 state to start a business in 2023 by Forbes.

Senator Bohacek said, “Small businesses are the backbone of our communities, and I believe offering this targeted tax relief would make Indiana an even greater destination for small businesses and start-ups.”

To learn more, click here.

Former Logansport police officer, wife pleads guilty to neglect

Former Logansport police officer, wife pleads guilty to neglect

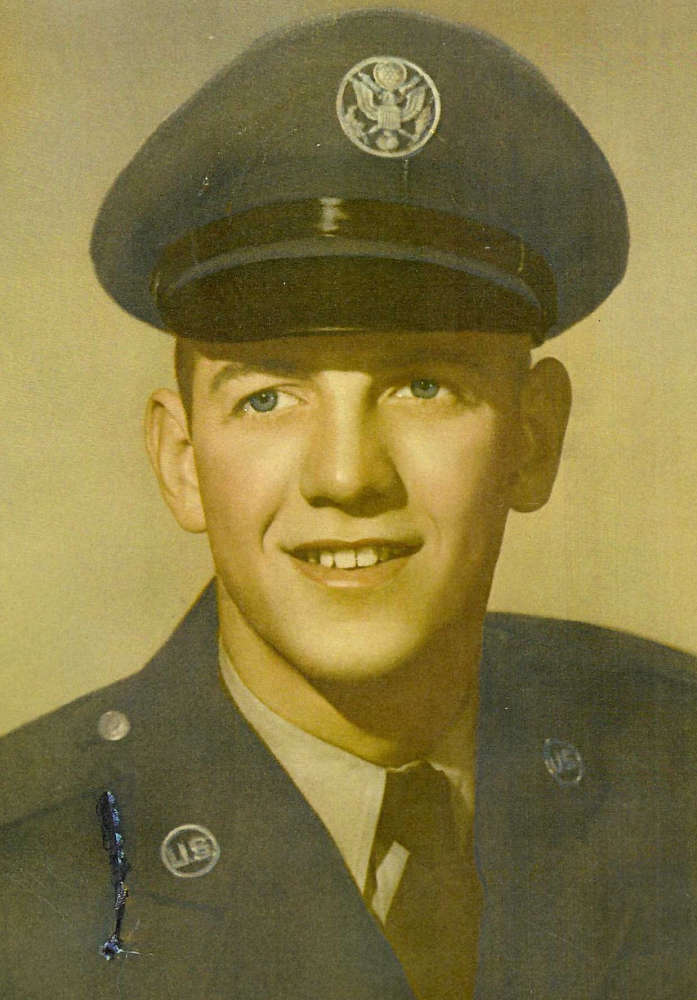

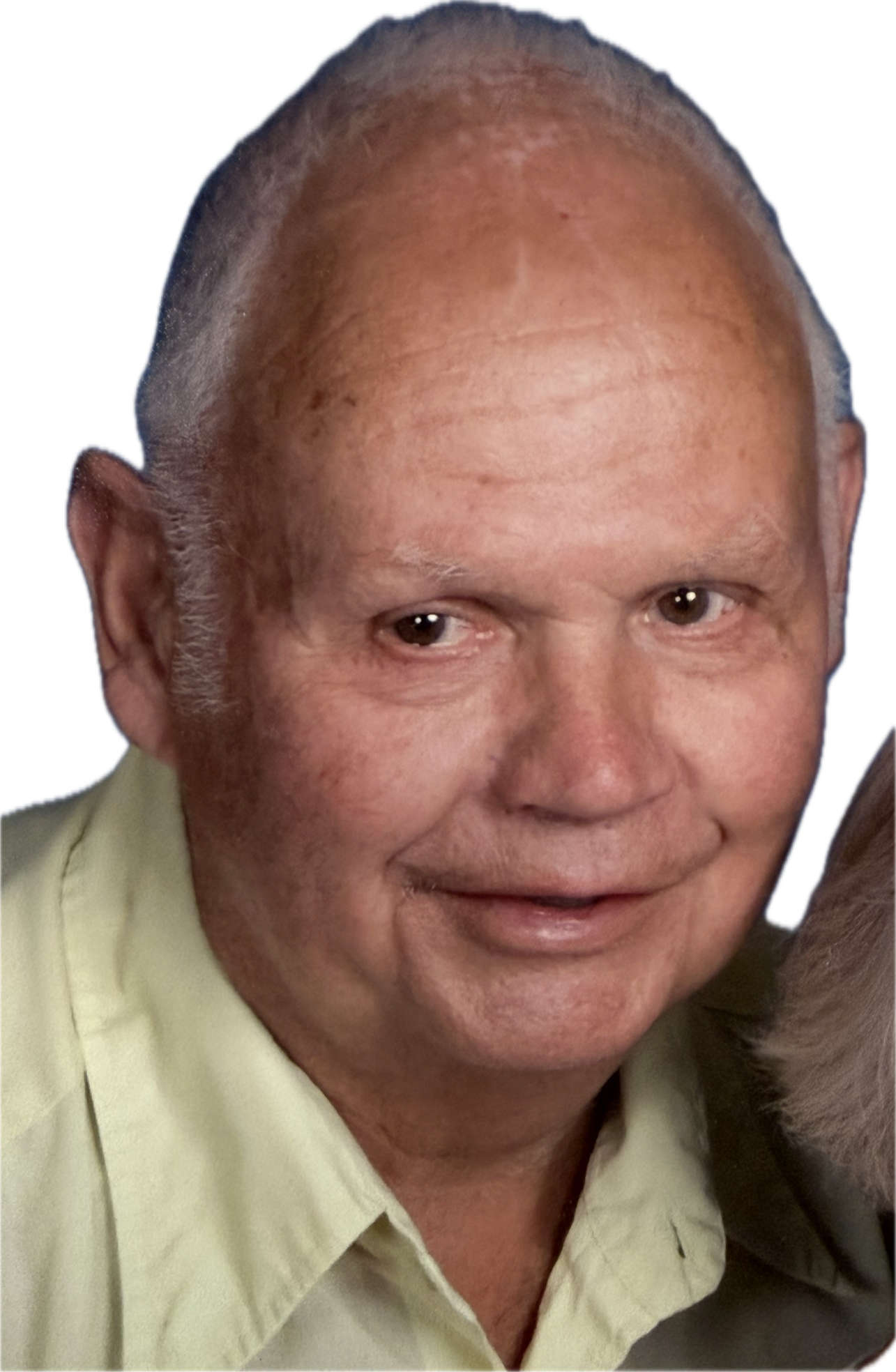

Indiana Department of Veterans Affairs, American Legion Department of Indiana sign landmark agreement

Indiana Department of Veterans Affairs, American Legion Department of Indiana sign landmark agreement

Deadline Thursday to nominate for Fulton County Chamber of Commerce awards

Deadline Thursday to nominate for Fulton County Chamber of Commerce awards

Rochester man charged with theft

Rochester man charged with theft

NWS calls for severe storm possibilities, locally heavy rain possible

NWS calls for severe storm possibilities, locally heavy rain possible

Two people riding a motorcycle seriously injured in collision with a truck

Two people riding a motorcycle seriously injured in collision with a truck