Lawrence County has been issued a tenative property assessment equalization factor of 1.000 according to the Illinois Department of Revenue.

The factor is often called the "multiplier". It is the method used to achieve uniform property assessments among counties, as required by law. State law requires property in Illinois to be assessed at 1/3 of its market value. Farm property in Illinois is assessed differently. Assessments here in Lawrence County at at 33.74% of market values, based on sales of properties in 2020, 2021 and 2022.

The factor currently being assigned to Lawrence County is for 2023 taxes payable in 2024. Last year, the equalization factor for the county was also 1.000.

One week left to file for office in Indiana

One week left to file for office in Indiana

Panel discussion held with city leaders at Wortman Family Civic Theatre

Panel discussion held with city leaders at Wortman Family Civic Theatre

Heaven and Horseshoes Community Center prepares to open at Horseshoe Indianapolis

Heaven and Horseshoes Community Center prepares to open at Horseshoe Indianapolis

Decatur and Bartholomew counties among grant recipients for cleanup, repair from Spring 2025 weather

Decatur and Bartholomew counties among grant recipients for cleanup, repair from Spring 2025 weather

Waldron High School teacher died Wednesday

Waldron High School teacher died Wednesday

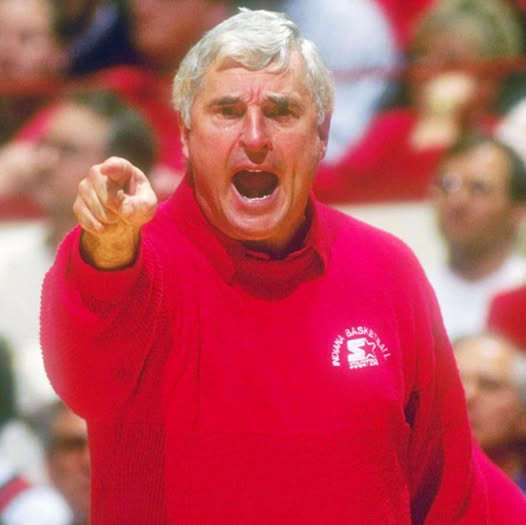

Road renaming resolution co-authored by Criswell to honor Bobby Knight passes House

Road renaming resolution co-authored by Criswell to honor Bobby Knight passes House

Edinburgh Police Department’s K9 Batu has received donation of body armor

Edinburgh Police Department’s K9 Batu has received donation of body armor

Shelby County to go TRAVEL ADVISORY at 5 p.m. Wednesday

Shelby County to go TRAVEL ADVISORY at 5 p.m. Wednesday