INvestABLE Indiana, the state’s ABLE savings and investment program, has surpassed $30 million in assets under management, marking a major milestone and reflecting strong growth driven by expanded eligibility and increased awareness among Hoosiers.

As of January 22, 2026, INvestABLE Indiana holds over $31.2 million in total assets, representing a 38% increase in overall assets year over year. The program also increased new accounts by over 200% compared to the same period last year.

Between January 1 and 22, 2026, INvestABLE Indiana welcomed 80 new enrollments and $176,626.37 in assets from new accounts. This is a dramatic leap from the same period in 2025, when just 26 new enrollments and $84,184.44 in new assets were recorded. The surge is largely attributed to expanded eligibility, which now empowers more Hoosiers—including veterans and those who acquire disabilities later in life—to benefit from an ABLE account. The result: more individuals than ever are securing their financial futures through INvestABLE Indiana.

“This milestone shows what’s possible when we remove barriers and give Hoosiers the tools they need to plan for the future,” said Treasurer of State Daniel Elliott. “INvestABLE Indiana empowers individuals with disabilities—and their families—to save with confidence, knowing their hard-earned dollars are protected while maintaining access to critical benefits. The strong growth we’re seeing confirms that expanding eligibility was the right move for Hoosiers across our state.”

INvestABLE Indiana offers individuals with disabilities and their families a secure pathway to save and invest for disability-related expenses—without risking access to essential means-tested benefits like Supplemental Security Income (SSI) or Medicaid. Account earnings grow tax-deferred, and withdrawals remain tax-free when used for Qualified Disability Expenses (QDEs), maximizing every dollar saved.

Qualified Disability Expenses cover any cost related to the account owner’s disability that enhances health, independence, or quality of life. Across Indiana, participants are leveraging INvestABLE accounts for vital needs: from home purchases and vehicle maintenance to travel, education, and long-term financial stability.

Indiana residents can also benefit from a state tax credit equal to 20% of their contributions—up to $500 per year—making INvestABLE Indiana even more accessible and impactful for families seeking to build lasting financial security.

For more information about INvestABLE Indiana or to open an account, visit in.savewithable.com.

Decatur and Bartholomew counties among grant recipients for cleanup, repair from Spring 2025 weather

Decatur and Bartholomew counties among grant recipients for cleanup, repair from Spring 2025 weather

Waldron High School teacher died Wednesday

Waldron High School teacher died Wednesday

Road renaming resolution co-authored by Criswell to honor Bobby Knight passes House

Road renaming resolution co-authored by Criswell to honor Bobby Knight passes House

Edinburgh Police Department’s K9 Batu has received donation of body armor

Edinburgh Police Department’s K9 Batu has received donation of body armor

Shelby County to go TRAVEL ADVISORY at 5 p.m. Wednesday

Shelby County to go TRAVEL ADVISORY at 5 p.m. Wednesday

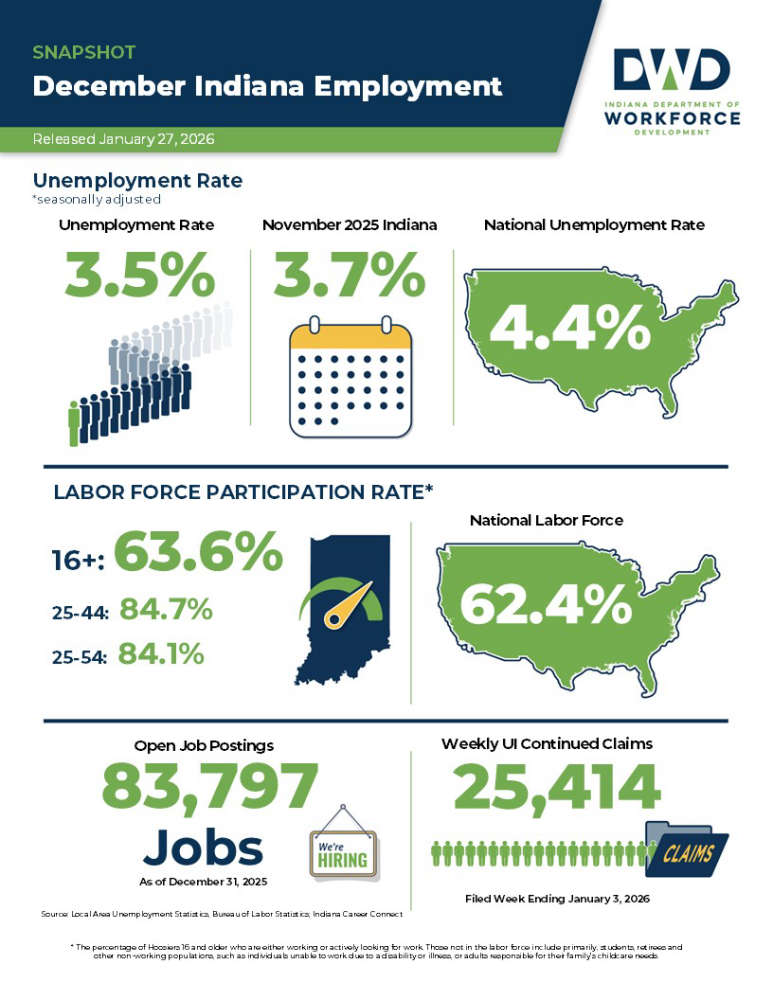

Indiana unemployment rate below national rate

Indiana unemployment rate below national rate

Shelby Materials, local contractors take home IRMCA project awards including 2025 Project of the Year Runner-Up

Shelby Materials, local contractors take home IRMCA project awards including 2025 Project of the Year Runner-Up

Shelbyville PD waiting on autopsy, toxicology in death investigation

Shelbyville PD waiting on autopsy, toxicology in death investigation