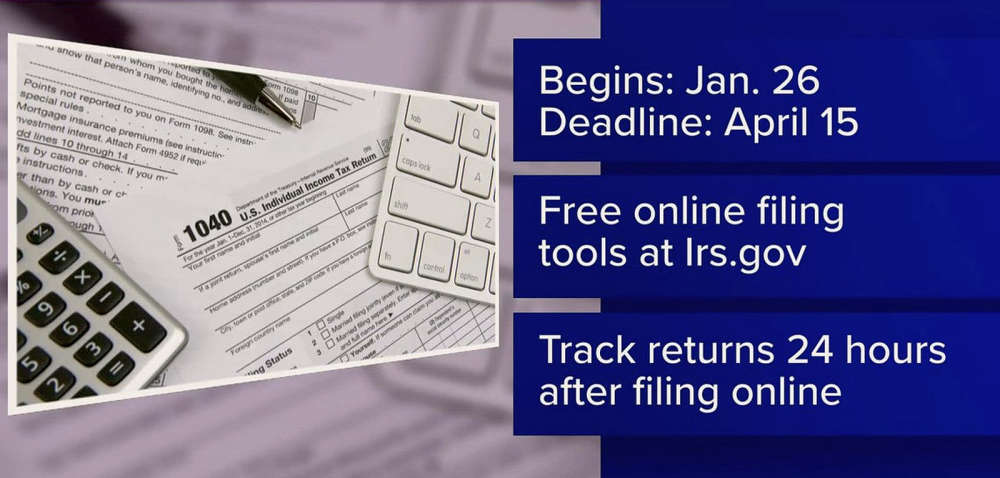

The Indiana Department of Revenue (DOR), along with the IRS, will start accepting filings for 2025 Individual Income tax returns on Monday, Jan. 26, 2026. Unless you are filing an extension, the deadline to file state and federal income tax returns and pay any taxes that are due is Wednesday, April 15, 2026.

DOR urges taxpayers not to file their state tax returns prior to Jan. 26 or before obtaining all required documents. Tax return submissions without proper documentation can result in processing and refund delays. Employers must provide wage statements by Jan. 31.

Taxpayers who file an extension must remember that the extension is for filing only and does not extend the deadline to pay the tax that is due.

DOR encourages taxpayers to use electronic filing, online payments, and direct deposit for faster processing and refunds.

Eligible taxpayers may be able to utilize electronic filing using DOR-approved online tax vendors through the INfreefile program available at www.in.gov/dor/i-am-a/

Additional information on Individual Income taxes, including extensions, late filings, and frequently asked questions, documentation required to file, and filing and payment options, is available at in.gov/dor/i-am-a/individual/.

Taxpayers who wish to contact DOR should use INTIME’s direct messaging feature at intime.dor.in.gov for the most efficient service.

New Palestine man killed in Hancock County crash

New Palestine man killed in Hancock County crash

Knights of Columbus with electronic pull-tabs available for play in Shelbyville

Knights of Columbus with electronic pull-tabs available for play in Shelbyville

Mainstreet Shelbyville retiring Wine Walk/Sip on the Square event in 2026

Mainstreet Shelbyville retiring Wine Walk/Sip on the Square event in 2026

SCS to host Parent Workshop later this month

SCS to host Parent Workshop later this month

Triton Central's Gray places eighth in IHSAA state championship meet

Triton Central's Gray places eighth in IHSAA state championship meet

Bridge replacement to close Hancock County road starting Feb 2

Bridge replacement to close Hancock County road starting Feb 2

Legal assistance available Monday with phone in clinic

Legal assistance available Monday with phone in clinic

USDA launches Lender Lens Dashboard to promote data transparency

USDA launches Lender Lens Dashboard to promote data transparency