Indiana Secretary of State Diego Morales reports that the Indiana Securities Division has joined a $17 million settlement with Edward D. Jones & Co., L.P. (Edward Jones) resulting from an investigation into the broker-dealer’s supervision of customers paying front-load commissions on investments which were later moved into fee-based advisory accounts, resulting in over charging.

The Indiana Securities Division, a member of the North American Securities Administrators Association (NASAA), was part of a working group of 14 state securities regulators that investigated Edward Jones’s supervision of customers prompted to move assets from brokerage to advisory accounts. Under U.S. Department of Labor (DOL) Fiduciary Rules, investment advice of retirement accounts is subject to a fiduciary standard of care, which Edward Jones was alleged to have violated.

The investigation found that Edward Jones charged front-load commissions for investments in Class A mutual fund shares in situations where the customer sold or moved the mutual fund shares sooner than originally anticipated. The states found gaps in Edward Jones’s supervisory procedures in this respect.

As part of the settlement, Edward Jones will pay an administrative fine of approximately $320,000 to each of the 50 states, Washington, D.C., the U.S. Virgin Islands, and Puerto Rico. As a lead state on the case, Indiana was awarded an additional amount for investigative costs. In evaluating the supervisory failures and determining the appropriate resolution, investigators considered certain facts such as the positive performance of the investment advisory accounts as compared to the brokerage accounts.

“In partnership with NASAA and other state securities regulators, we will continue to protect Main Street investors and ensure that companies operating in Indiana follow our securities laws. The Indiana Securities Division appreciates the ongoing cooperation of Edward Jones throughout this investigation and settlement process. Firms that offer both brokerage and investment advisory services should be mindful of fiduciary responsibility owed to customers and their investment assets.” said Diego Morales, Indiana Secretary of State.

Grand Opening for Heaven and Horseshoes Community Center held at Horseshoe Indianapolis

Grand Opening for Heaven and Horseshoes Community Center held at Horseshoe Indianapolis

ISP protect Hoosier kids from online predators

ISP protect Hoosier kids from online predators

Shelbyville Fire Department hosts awards banquet

Shelbyville Fire Department hosts awards banquet

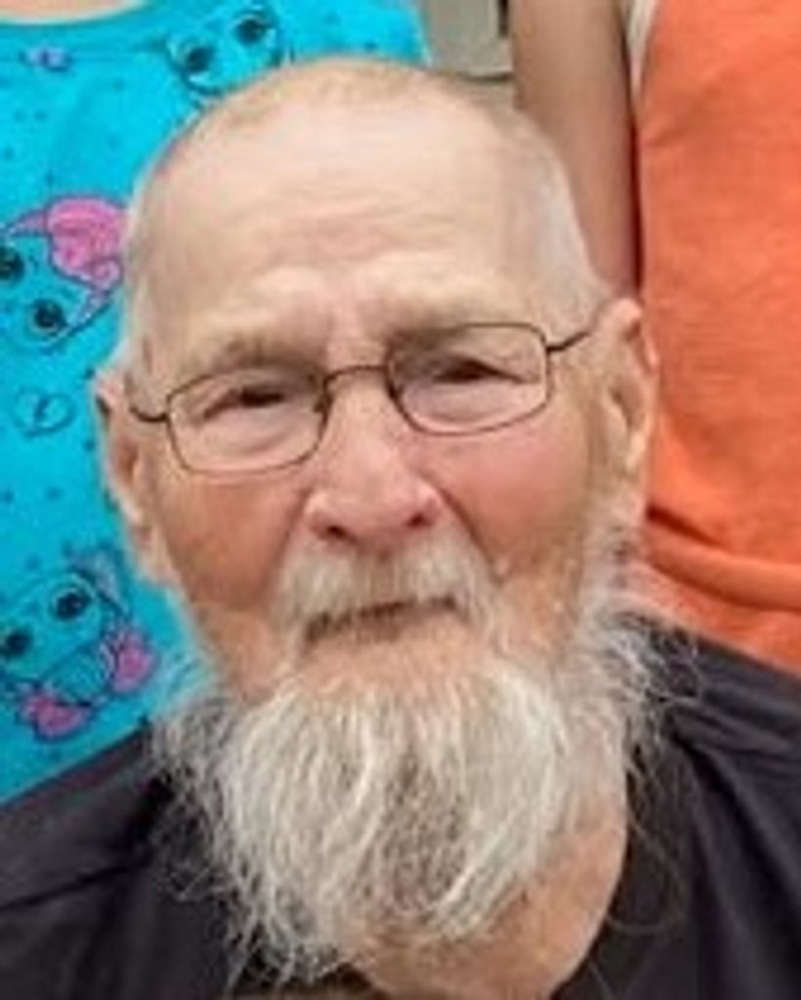

Patrick M. Ellis, 33, of Shelbyville

Patrick M. Ellis, 33, of Shelbyville

Indiana BMV to offer Disability Blackout plate

Indiana BMV to offer Disability Blackout plate

U.S. Postal Service to observe Presidents Day, Feb. 16

U.S. Postal Service to observe Presidents Day, Feb. 16

Greene's bill to aid ABA therapy in schools moves to Senate

Greene's bill to aid ABA therapy in schools moves to Senate

Laird to run for Shelby County Clerk

Laird to run for Shelby County Clerk