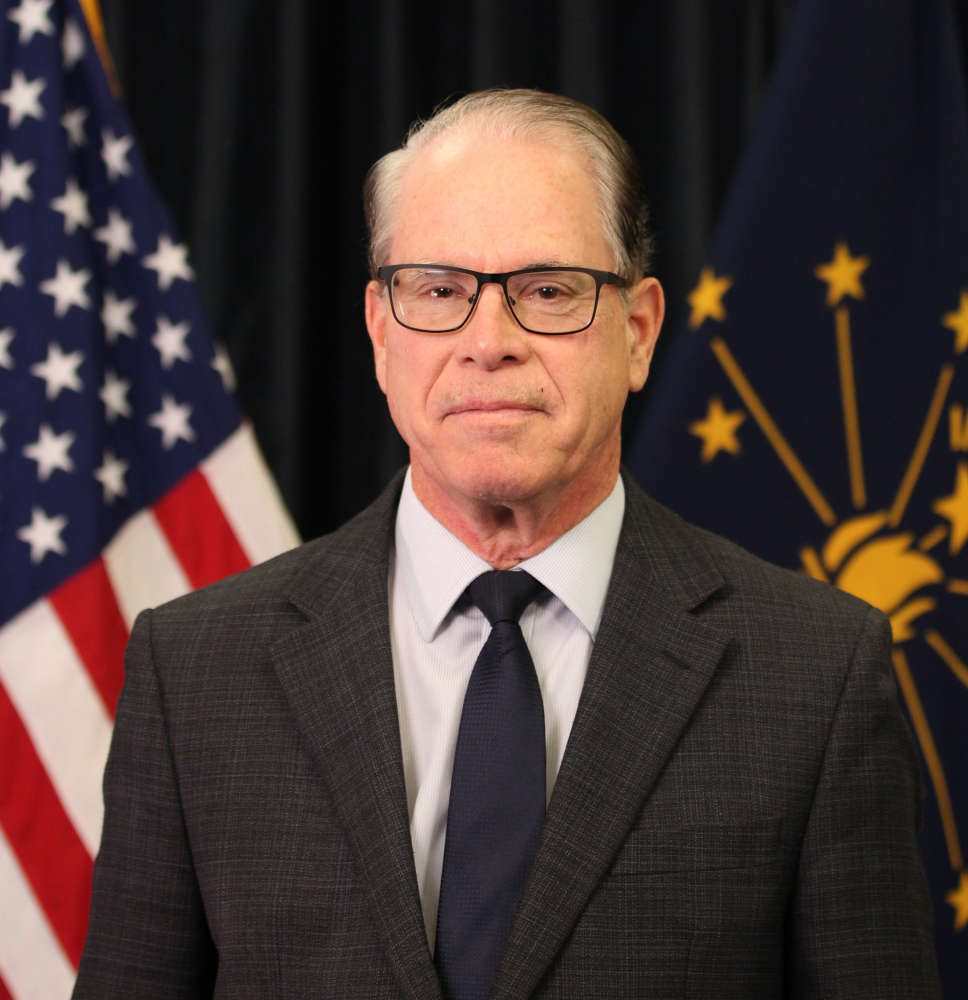

Governor Mike Braun will today sign a proclamation calling a special legislative session for the General Assembly to convene on Nov. 3 to consider altering the boundaries of Indiana’s congressional districts and to consider resolving an important issue regarding federal and state tax compliance that must be addressed.

“I am calling a special legislative session to protect Hoosiers from efforts in other states that seek to diminish their voice in Washington and ensure their representation in Congress is fair. I am also asking the legislature to conform Indiana's tax code with new federal tax provisions to ensure stability and certainty for taxpayers and tax preparers for 2026 filings.” — Governor Mike Braun

Indiana uses federal tax law as the starting point for the Indiana tax return, and the recent changes to federal tax law in the One Big Beautiful Bill Act include provisions that impact Indiana state tax filings.

Addressing this discrepancy through a special session will provide taxpayers, accountants, and businesses the confidence and clarity ahead of filing season, avoid amended returns and filing delays, and continue the Indiana Department of Revenue’s strong record of fiscal management.

Shelby County EMA makes sandbags available with Flood Warning in effect, more rain expected

Shelby County EMA makes sandbags available with Flood Warning in effect, more rain expected

Indiana earns top credit rating from major agency

Indiana earns top credit rating from major agency

Heavy rainfall provided realistic training Wednesday for Shelbyville's Swift Water Rescue Team

Heavy rainfall provided realistic training Wednesday for Shelbyville's Swift Water Rescue Team

Coulston Elementary School awarded Library Makeover Grant

Coulston Elementary School awarded Library Makeover Grant

Red Cross seeks donations to curb severe blood shortage

Red Cross seeks donations to curb severe blood shortage

Funeral services at Southwestern for Nicole A. (Hillebrand) Mays

Funeral services at Southwestern for Nicole A. (Hillebrand) Mays

Sen. Crider welcomes Shelbyville's Sellers, Triton Central's Coen to Statehouse as Senate pages

Sen. Crider welcomes Shelbyville's Sellers, Triton Central's Coen to Statehouse as Senate pages

City of Shelbyville dealing with resignation and retirement from two key positions

City of Shelbyville dealing with resignation and retirement from two key positions