The Illinois Department of Revenue (IDR) has issued a final property assessment equalization factor of .9477 for Lawrence County.

The property assessment equalization factor, also known as the "multiplier" is the method used to achieve uniform property assessments among counties as required by Illinois law. Property in Illinois is assessed at 1/3 of its market value. Farm property in Illinois is assessed differently. Assessments in Lawrence County are at 35.17% of market value, based on the sales of properties in the years 2021. 2022 and 2023.

The final factor was issued by the IDR after a required public hearing. The equalization factor currently being assigned is for 2024 taxes, payable in 2025. The 2024 equalization factor for the county was 1.000.

Greencastle - Parke Heritage again, South Putnam vs Southmont on GIANT fm Sports

Greencastle - Parke Heritage again, South Putnam vs Southmont on GIANT fm Sports

Putnam County Friends of the NRA Banquet set for March

Putnam County Friends of the NRA Banquet set for March

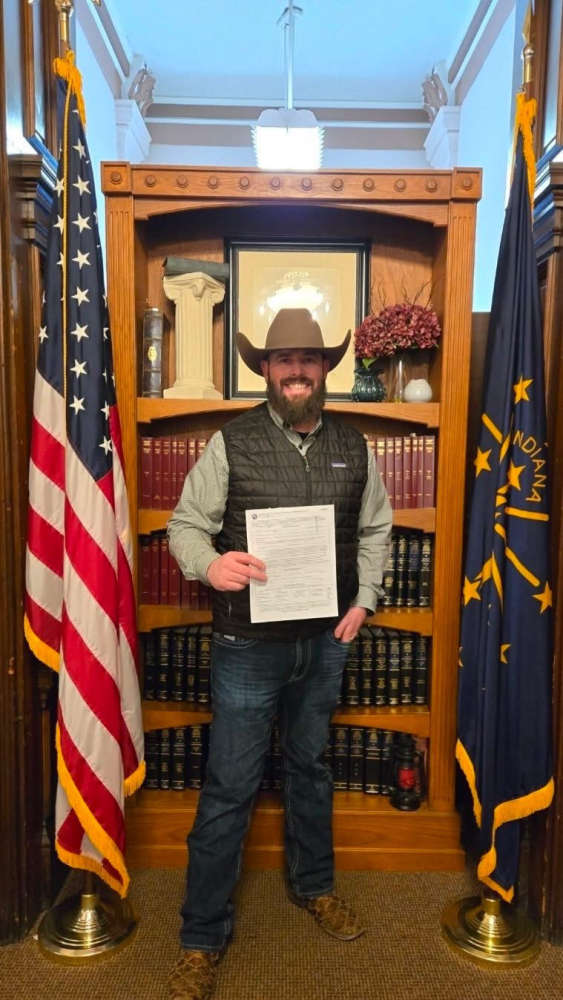

Cooper ready to run for Statehouse seat

Cooper ready to run for Statehouse seat

Fidler ready to represent on Putnam County Council

Fidler ready to represent on Putnam County Council

BrunchBird ready to serve up food, drinks for customers

BrunchBird ready to serve up food, drinks for customers

Bill to increase access to veterinarians signed into law

Bill to increase access to veterinarians signed into law

United Way of Central Indiana awards $25,000 grant to Beyond Homeless

United Way of Central Indiana awards $25,000 grant to Beyond Homeless

INDOT implements new roadway worker safety initiative: Project Greenlight

INDOT implements new roadway worker safety initiative: Project Greenlight