Lawrence County has been issued a tenative property assessment equalization factor of 1.000 according to the Illinois Department of Revenue.

The factor is often called the "multiplier". It is the method used to achieve uniform property assessments among counties, as required by law. State law requires property in Illinois to be assessed at 1/3 of its market value. Farm property in Illinois is assessed differently. Assessments here in Lawrence County at at 33.74% of market values, based on sales of properties in 2020, 2021 and 2022.

The factor currently being assigned to Lawrence County is for 2023 taxes payable in 2024. Last year, the equalization factor for the county was also 1.000.

Owen Valley HS receives FEMA grant for repair from 2025 Spring storms

Owen Valley HS receives FEMA grant for repair from 2025 Spring storms

One week left to file for office in Indiana

One week left to file for office in Indiana

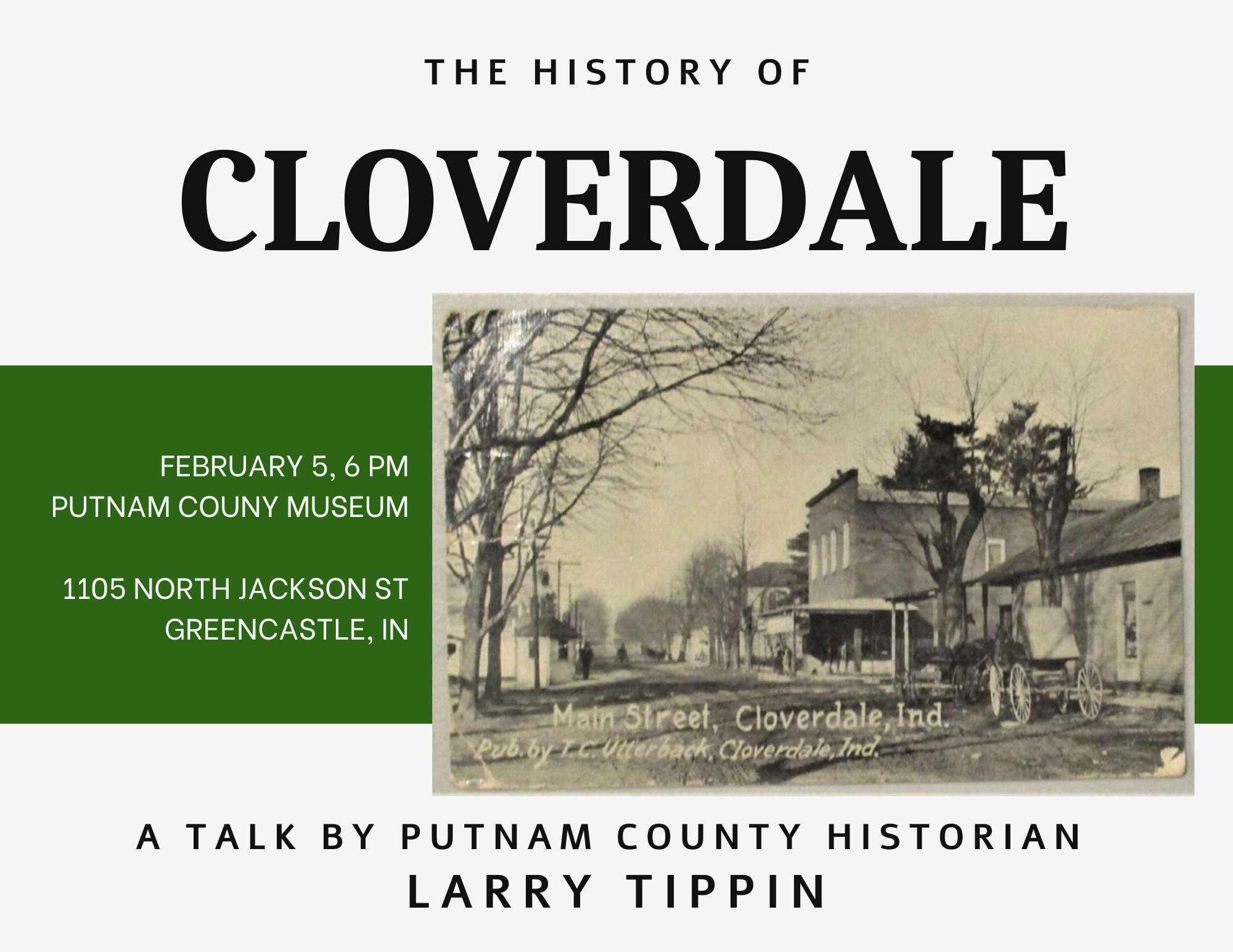

History of Cloverdale – Talk at Putnam County Museum

History of Cloverdale – Talk at Putnam County Museum

“Exploring 4-H” for Grade 2 Kicks off in February

“Exploring 4-H” for Grade 2 Kicks off in February

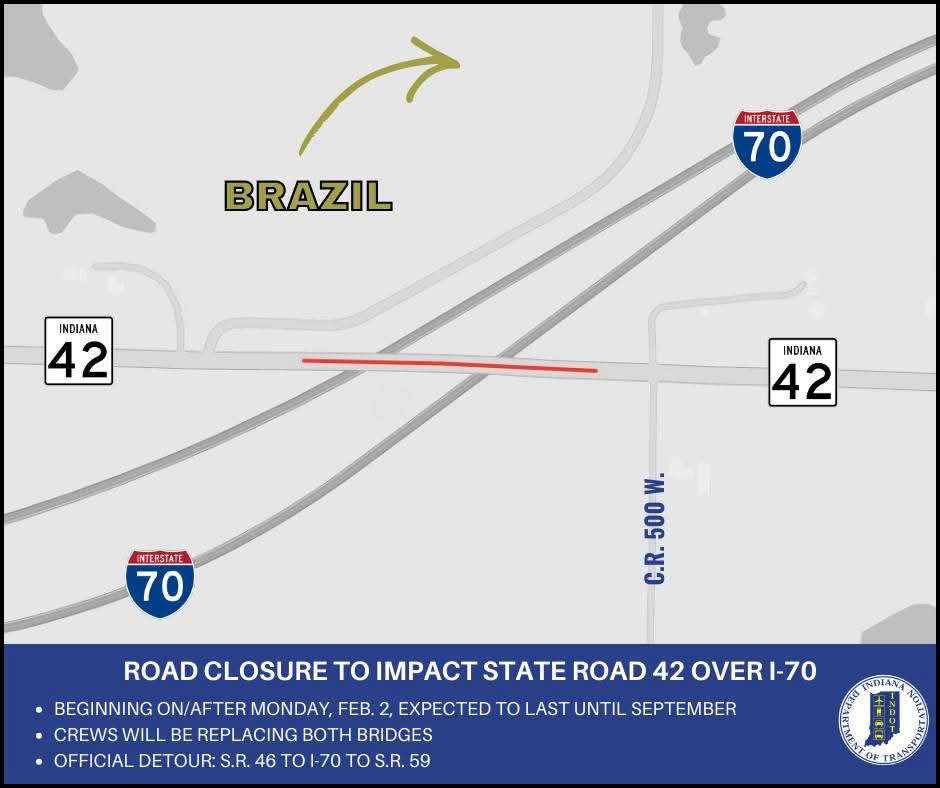

Bridge closures to impact State Road 42 over I-70 in Clay County

Bridge closures to impact State Road 42 over I-70 in Clay County

South Putnam's Burgess leaves the Nest

South Putnam's Burgess leaves the Nest

LEGO® Fans Food Drive

LEGO® Fans Food Drive

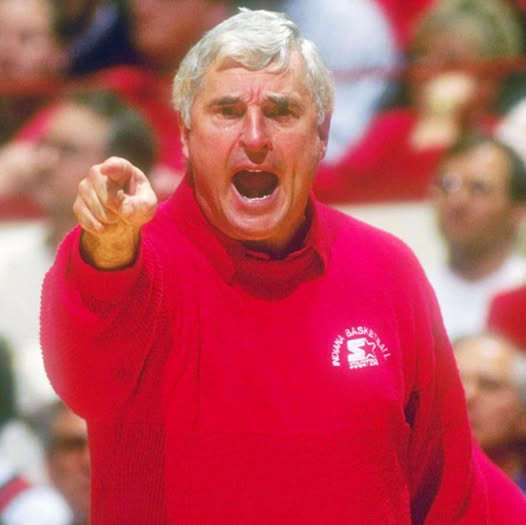

Road renaming resolution co-authored by Criswell to honor Bobby Knight passes House

Road renaming resolution co-authored by Criswell to honor Bobby Knight passes House