News

Monday evening the Plymouth Common Council accepted Tax Incremental Finance (TIF) Compliance Forms from three industries.

City Attorney jeff Houin told the council three companies, Farm Innovators, Riverside Commons and Complexus Medical each have real property tax abatements and Complexus Medical also has a personal property tax abatement.

Each year companies that have been granted a tax abatement from the City of Plymouth must submit annual compliance through a CF1 form. The form includes their expected investment and employment results as well as the assessed values. During the term of the abatement, they are required to file annually their current standings.

City Council members had no questions and motioned to approve the CF1 forms saying that each company showed substantial compliance with their projections.

No intentional wrongdoing alleged in crash blamed for death of US Rep. Baird’s wife

No intentional wrongdoing alleged in crash blamed for death of US Rep. Baird’s wife

Owen County woman behind bars for Poland death

Owen County woman behind bars for Poland death

Indiana earns top credit rating from major agency

Indiana earns top credit rating from major agency

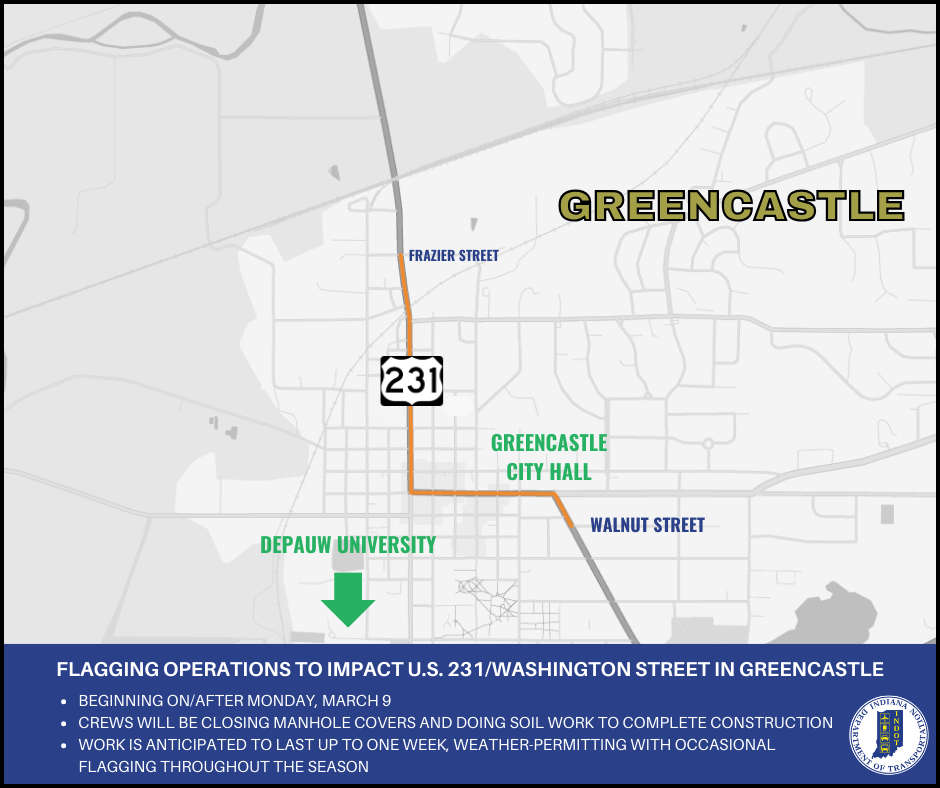

Intermittent flagging to impact U.S. 231 (Washington Street) in Greencastle

Intermittent flagging to impact U.S. 231 (Washington Street) in Greencastle

Fuller Center seeks applicants for Greencastle home build

Fuller Center seeks applicants for Greencastle home build

Red Cross seeks donations to curb severe blood shortage

Red Cross seeks donations to curb severe blood shortage

Greencastle - Parke Heritage again, South Putnam vs Southmont on GIANT fm Sports

Greencastle - Parke Heritage again, South Putnam vs Southmont on GIANT fm Sports