As Hoosiers begin filing their taxes, they will start to see bigger paychecks, larger refunds, and expanded opportunities to build long-term financial security because President Trump and Congressional Republicans passed the Working Families Tax Cuts.

“The Working Families Tax Cuts were designed to deliver real relief for Hoosiers and families across the country,” Rep. Yakym said. “By eliminating taxes on tips and overtime, expanding deductions for seniors, permanently doubling the standard deduction, and investing in the next generation through Trump Accounts, this legislation puts more money back into Hoosiers’ pockets. Families will see meaningful tax relief, stronger paychecks, and greater financial stability.”

KEY ELEMENTS OF THE WORKING FAMILIES TAX CUTS BELOW:

BIGGER TAX REFUNDS IN 2026

Americans will see historic refund levels this tax season:

- Nearly $4,000 average tax refund

- $100 BILLION in total tax refunds projected nationwide

- Refund levels among the highest in years

- 66% of the WFTC’s tax cuts benefit families earning less than $500,000

MORE MONEY IN EVERY PAYCHECK

Tax relief is boosting take-home pay all year long:

- Over $10,000 more in annual take-home pay for working families

- 15% average tax cut for Americans earning $15,000–$80,000

- More than 94% of middle-income working families receive a tax cut

PERMANENT TAX RELIEF FOR WORKING FAMILIES

The Working Families Tax Cuts locks in long-term tax benefits:

- Standard deduction permanently doubled — used by 90% of American taxpayers

- Lower tax rates and brackets made permanent — locks in reduced rates from the Trump tax cuts

TRUMP ACCOUNTS: A STRONG FINANCIAL START FOR EVERY AMERICAN CHILD

The Working Families Tax Cuts also establishes Trump Accounts, giving every newborn American a financial foundation from day one.

WHAT FAMILIES RECEIVE

- $1,000 federal contribution for every American child born between January 1, 2025 – December 31, 2028

- Account is fully in the child’s name, and parents are custodians until age 18

- Families have the option to contribute up to $5,000 per year

WHAT $1,000 BECOMES OVER TIME

Even without additional contributions, long-term growth can provide:

- $6,000 by age 18

- $15,000 by age 27

- $243,000 by age 55

All from a one-time $1,000 federal investment.

Applications open for new United Way of Central Indiana initiative to build community solutions

Applications open for new United Way of Central Indiana initiative to build community solutions

New nature preserve dedicated in Owen County, another expanded in Lake County

New nature preserve dedicated in Owen County, another expanded in Lake County

Utilities District of Western Indiana REMC announces increases over next three years

Utilities District of Western Indiana REMC announces increases over next three years

Friday is National Wear Red Day

Friday is National Wear Red Day

Owen Valley HS receives FEMA grant for repair from 2025 Spring storms

Owen Valley HS receives FEMA grant for repair from 2025 Spring storms

One week left to file for office in Indiana

One week left to file for office in Indiana

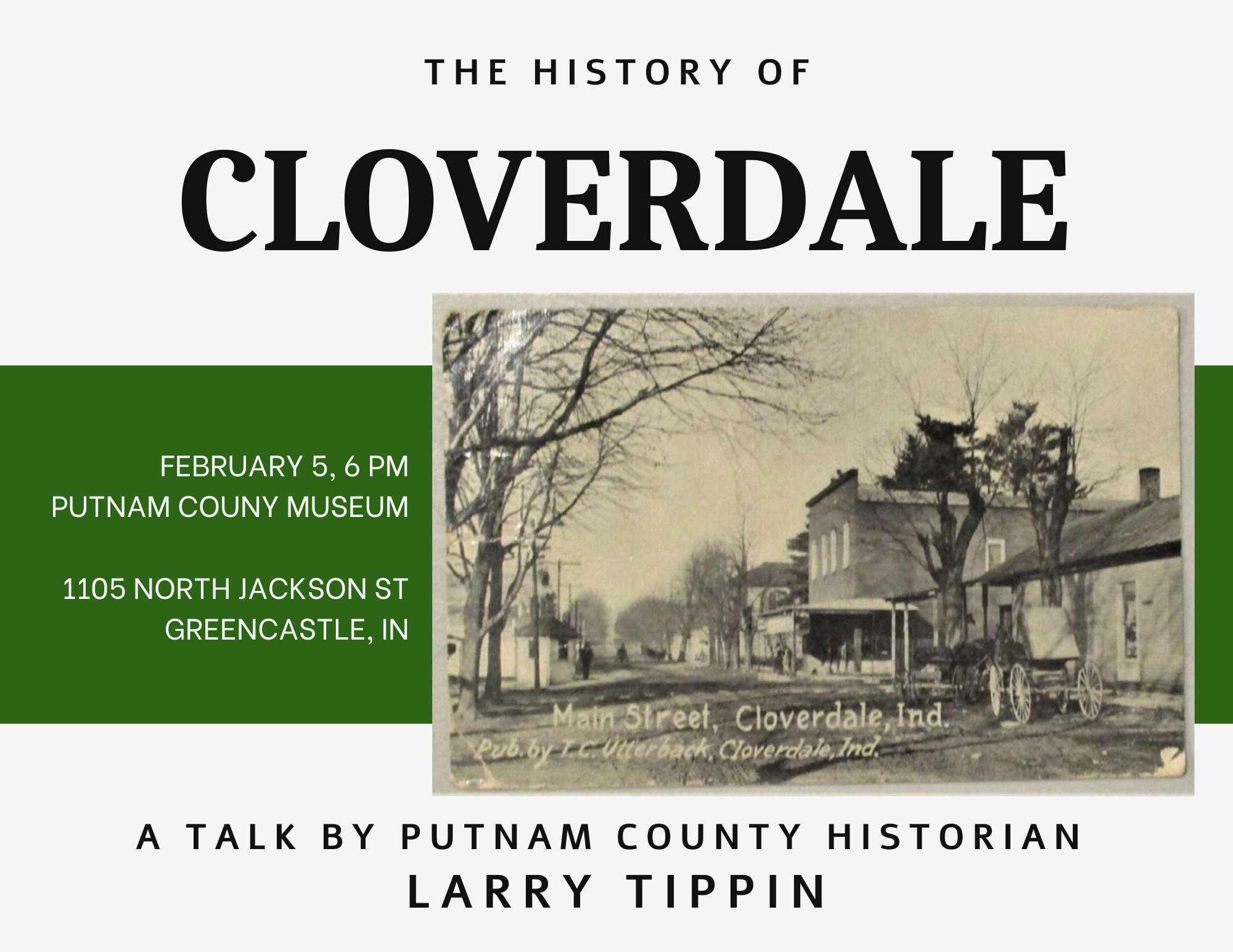

History of Cloverdale – Talk at Putnam County Museum

History of Cloverdale – Talk at Putnam County Museum

“Exploring 4-H” for Grade 2 Kicks off in February

“Exploring 4-H” for Grade 2 Kicks off in February