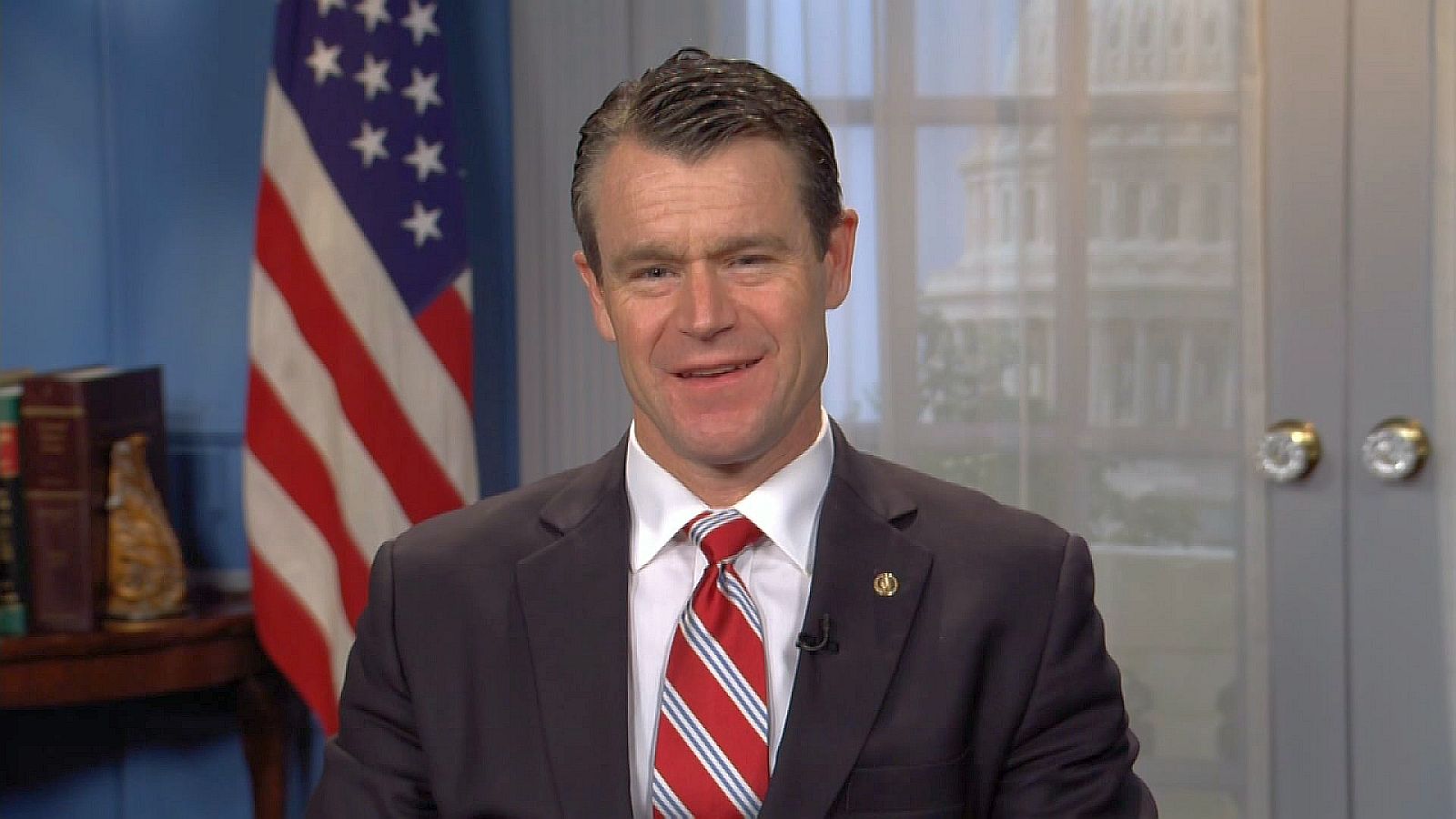

U.S. Senators Todd Young (R-Ind.) and Maggie Hassan (D-N.H.) reintroduced their bipartisan American Innovation and Jobs Act to support research and development (R&D) investments by innovative companies across Indiana and the United States.

Currently, businesses and startups investing in R&D can claim tax incentives that help them to invest in developing new, innovative products that lead to additional jobs and a stronger economy. The American Innovation and Jobs Act builds on this by expanding the refundable R&D tax credit and ensuring that businesses can once again fully deduct R&D expenses each year.

“Maintaining and encouraging R&D activities here in the United States is critical to providing high-quality jobs for Americans and ensuring our country remains competitive with our international rivals, most notably China,” said Senator Young. “Our American Innovation and Jobs Act would ensure businesses can fully deduct R&D expenses each year and expand the R&D tax credit for startups and small businesses. If we want to outcompete and out-innovate the Chinese Communist Party, we must pass this legislation as soon as possible.”

“When American companies invest in research and development to develop new products and technologies, it stimulates our economy, promotes job growth, and helps us compete with foreign adversaries,” said Senator Hassan. “I was proud to lead the effort to double the R&D tax credit for small businesses and startups in the Inflation Reduction Act, and am continuing the push with Senator Young to further expand these tax incentives. Our bipartisan bill will help more startups and businesses invest in research and development, and also ensure that they can fully deduct research and development expenses each year. I urge my colleagues on both sides of the aisle to support this bill that will spur innovation.”

The bipartisan American Innovation and Jobs Act supports innovative businesses and helps create jobs by:

Restoring incentives for long-term R&D investment by ensuring that companies can fully deduct R&D expenses each year Raising the cap over time for the refundable R&D tax credit for small businesses and startups Expanding eligibility for the refundable R&D tax credit so that more startups and new businesses can use itSenator Young has long supported investments in R&D. He introduced the American Innovation and Jobs Act in 2020 and 2021, and introduced a motion in 2022 to incentivize R&D investment in the United States, which passed the Senate by a vote of 90 to 5. In addition, Young led a bipartisan group of his colleagues in urging Senate leadership to expand the R&D tax credit and support U.S. economic competitiveness and innovation.

In addition to Senators Young and Hassan, Senators Cortez-Masto (D-Nev.), Barrasso (R-Wyo.), Sinema (I-Ariz.), Tillis (R-N.C.), Feinstein (D-Calif.), Daines (R-Mont.), Kelly (D-Ariz.), Hagerty (R-Tenn.), Murray (D-Wash.), Moran (R-Kan.), Peters (D-Mich.) and Wicker (R-Miss.) were also original cosponsors.

More about the bill can be found here.

Martin looks to bring experience to Parke County Commissioner District 2 Seat

Martin looks to bring experience to Parke County Commissioner District 2 Seat

Penny-rounding for retailers

Penny-rounding for retailers

No intentional wrongdoing alleged in crash blamed for death of US Rep. Baird’s wife

No intentional wrongdoing alleged in crash blamed for death of US Rep. Baird’s wife

Hoover looks to turn Parke County Commissioner District 2 seat Blue

Hoover looks to turn Parke County Commissioner District 2 seat Blue

Indiana earns top credit rating from major agency

Indiana earns top credit rating from major agency

Fairview Park receives OCRA grant to rehab water system

Fairview Park receives OCRA grant to rehab water system

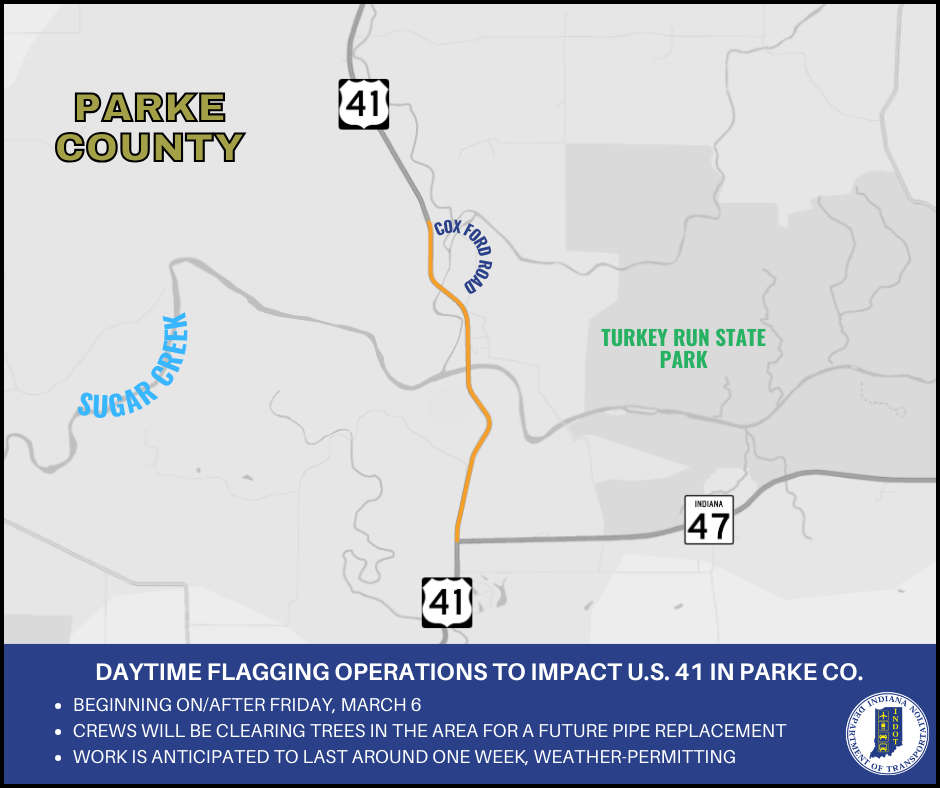

Daytime flagging operations to impact U.S. 41 for tree clearing for a future project

Daytime flagging operations to impact U.S. 41 for tree clearing for a future project

Rosedale man charged with child molesting, soliciting

Rosedale man charged with child molesting, soliciting

Red Cross seeks donations to curb severe blood shortage

Red Cross seeks donations to curb severe blood shortage

Greencastle - Parke Heritage again, South Putnam vs Southmont on GIANT fm Sports

Greencastle - Parke Heritage again, South Putnam vs Southmont on GIANT fm Sports

Bill to increase access to veterinarians signed into law

Bill to increase access to veterinarians signed into law

INDOT implements new roadway worker safety initiative: Project Greenlight

INDOT implements new roadway worker safety initiative: Project Greenlight

Southwest Parke schools synchronous e-learning on Wednesday

Southwest Parke schools synchronous e-learning on Wednesday

Chase Edward Bennett, 17, of Hillsdale

Chase Edward Bennett, 17, of Hillsdale

Riverton Parke student-athlete dies in automobile crash

Riverton Parke student-athlete dies in automobile crash

USDA announces enrollment period for Farmer Bridge Payments

USDA announces enrollment period for Farmer Bridge Payments