U.S. Senators Todd Young (R-Ind.) and Ruben Gallego (D-Ariz.) introduced the Uplifting First-Time Homebuyers Act, legislation to help more Americans buy their first home by increasing the Individual Retirement Account (IRA) tax exception withdrawal limit for first-time homebuyers.

“Homeownership is critical to strengthening families, building generational wealth, and cultivating stronger communities. By updating the IRA withdrawal limits to better match the realities of today’s economy, our bill will unlock more opportunities for Americans to become homeowners and invest in their future,” said Senator Young.

“Homeownership is the cornerstone of the American dream, and for good reason. Owning a home is a proven way to build generational wealth and retirement security. But too many young Americans feel like that dream is out of reach,” said Senator Gallego. “By updating the decades-old IRA homebuyer exception to reflect the reality of housing costs today, this bill helps make homeownership possible for the next generation.”

In 1997, Congress created a tax provision allowing first-time homebuyers to withdraw up to $10,000 from their IRAs without incurring the standard 10% early withdrawal penalty. At the time, the median home price was $115,000. Today, the median price has nearly quadrupled, yet the $10,000 cap has not been updated.

The Uplifting First-Time Homebuyers Act would raise the qualified distribution limit to $50,000, better aligning it with today’s housing market realities. This withdrawal can be used to buy, build, or rebuild a first home.

The bill is endorsed by the National Housing Conference, National Community Reinvestment Coalition, National Coalition for the Homeless, National Association of REALTORS®, National Association of Hispanic Real Estate Professionals®, Mortgage Bankers Association, and Chamber of Progress.

“The Uplifting First-Time Homebuyers Act is a smart, targeted step toward making homeownership more attainable,” said Shannon McGahn, Executive Vice President & Chief Advocacy Officer, National Association of REALTORS®. “By updating the outdated IRA withdrawal limit, this bill could give first-time buyers greater access to their own savings at the moment they need it most. With the median age of first-time buyers now at 38, this commonsense fix helps more Americans achieve the dream of homeownership earlier in life—and start building equity and long-term financial stability.”

Full text of the legislation can be found here.

Ray Allison named next executive director of the Indiana State Fair Commission

Ray Allison named next executive director of the Indiana State Fair Commission

INvestABLE Indiana announces expanded eligibility criteria beginning January 1

INvestABLE Indiana announces expanded eligibility criteria beginning January 1

Governor Braun announces record year for Indiana tourism

Governor Braun announces record year for Indiana tourism

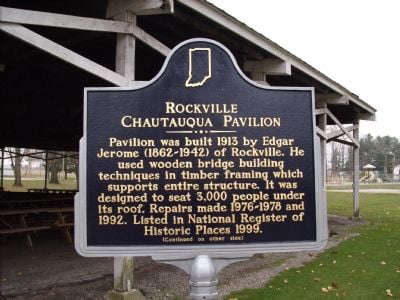

Rockville Parks Board continues working on quality of life improvements

Rockville Parks Board continues working on quality of life improvements

Indiana advances coal ash permitting program

Indiana advances coal ash permitting program

Indiana's state parks offer New Years Day events

Indiana's state parks offer New Years Day events

Rockville Council strips Clerk-Treasurer of Town Manager duties

Rockville Council strips Clerk-Treasurer of Town Manager duties

DNR receives regional award for project on former mine land near Pleasantville

DNR receives regional award for project on former mine land near Pleasantville

ISP shopping safety tips

ISP shopping safety tips

Riverton Parke's Emily Adams awarded the Lilly Endowment Community Scholarship for Parke County

Riverton Parke's Emily Adams awarded the Lilly Endowment Community Scholarship for Parke County

BMV announces Christmas and New Year's Day holiday hours

BMV announces Christmas and New Year's Day holiday hours

Indiana launches Smart SNAP

Indiana launches Smart SNAP

Indiana 211: Connecting Hoosiers to holiday support and essential resources

Indiana 211: Connecting Hoosiers to holiday support and essential resources

Department of Homeland Security launches Worst of the Worst website

Department of Homeland Security launches Worst of the Worst website

Governor Braun takes action to waive hours-of-service regulations for transporting propane

Governor Braun takes action to waive hours-of-service regulations for transporting propane

Two Indiana State Fair Commission executives elected to prominent national IAFE Positions, Indiana State Fair honored with multiple awards

Two Indiana State Fair Commission executives elected to prominent national IAFE Positions, Indiana State Fair honored with multiple awards

Cover Crop Premium Discount Program available for Hoosier farmers, new pre-enrollment available

Cover Crop Premium Discount Program available for Hoosier farmers, new pre-enrollment available

Indiana FSSA extends open enrollment for HIP and PathWays Plans through December 24

Indiana FSSA extends open enrollment for HIP and PathWays Plans through December 24