U.S. Senators Todd Young (R-Ind.), Jacky Rosen (D-Nev.), Ted Budd (R-N.C.), and Jeanne Shaheen (D-N.H.) introduced legislation to help small business owners integrate digital tools into their businesses.

The Small Business Technological Advancement Act would clarify that small businesses can utilize the Small Business Administration’s (SBA) 7(a) loan program to finance technology that supports daily operations, including inventory management, product delivery, and accounting systems.

“Small businesses are the lifeblood of Indiana’s economy,” said Senator Young. “Our bill will promote the adoption of digital tools so that Hoosier small businesses can better compete in today’s economy.”

“Small businesses are the backbone of Nevada’s economy, and I’m committed to helping them thrive in any way I can,” said Senator Rosen. “That’s why I’m helping to introduce this bipartisan bill that will free up federal resources to make sure small businesses have the technological support they need to modernize their operations and continue to compete.”

“Ensuring that small business can use 7(a) loans for digital tools is a commonsense way to help job creators compete in the modern economy. I thank Senator Young for proposing this bill,” said Senator Budd.

“In an increasingly digital world, more and more companies are using technology to modernize operations and compete globally. To ensure our small businesses can compete too, we must cut red tape to allow them to utilize digital tools to help manage and grow their businesses,” said Senator Shaheen. “Our commonsense, bipartisan bill will empower small businesses to use SBA’s 7(a) loans to access new software, digital tools, and online work.”

The last few years have seen an accelerated digital transformation among small businesses, pushing software adoption for business continuity and customer engagement. The Small Business Technological Advancement Act would help small businesses continue to bridge this technological gap by amending the Small Business Act to clarify that 7(a) loan borrowers can finance business software or cloud computing services for the following:

- Facilitating daily operations.

- Product or service delivery.

- Processing, payment, and tracking of payroll expenses.

- Human resources.

- Sales and billing functions; and/or

- Accounting or tracking of supplies, inventory, records, and expenses.

The entire legislative text can be found here.

DNR holiday gift packs available for limited time

DNR holiday gift packs available for limited time

Gov. Braun issues available SNAP benefits, State prepared to distribute full amount once available

Gov. Braun issues available SNAP benefits, State prepared to distribute full amount once available

IDOH approves Union - Regional hospital merger

IDOH approves Union - Regional hospital merger

Winter Weather Advisory issued

Winter Weather Advisory issued

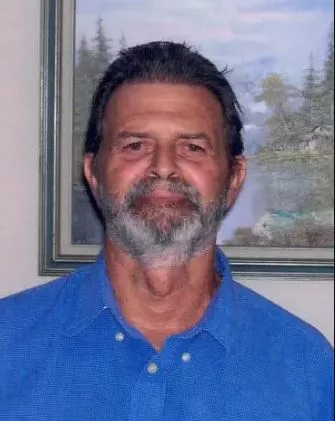

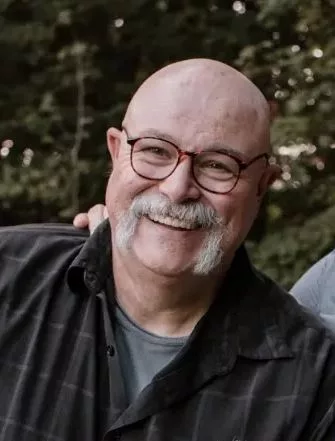

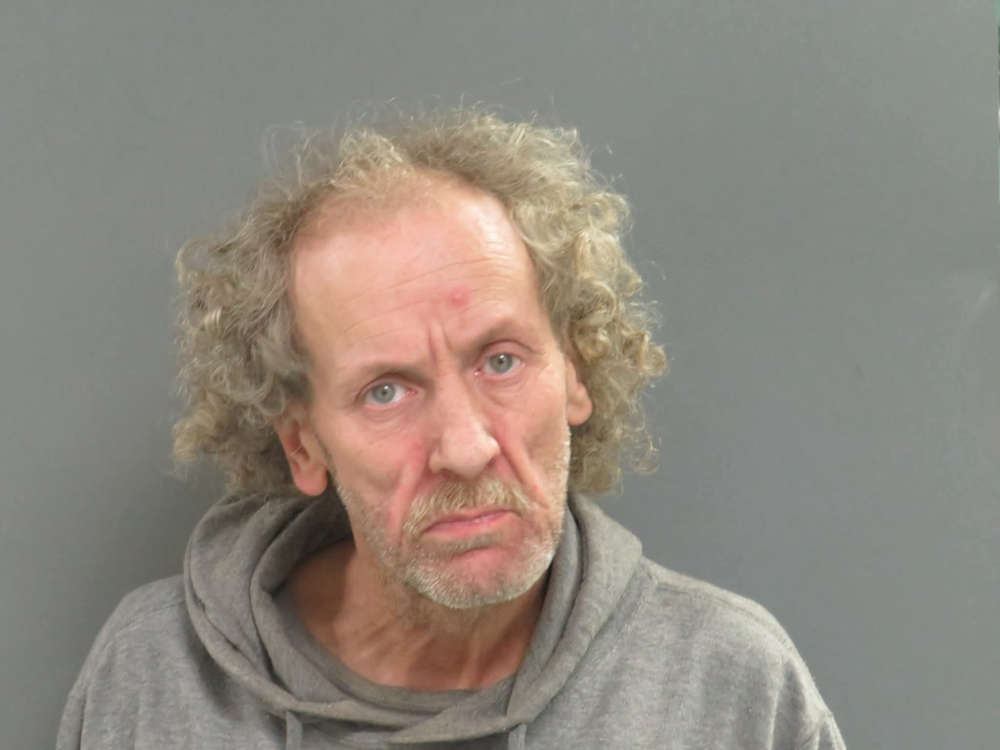

Pair of traffic stops net arrests

Pair of traffic stops net arrests

Eagles look to soar to sectional crown

Eagles look to soar to sectional crown

Riverton Parke looks to get over sectional hump

Riverton Parke looks to get over sectional hump

Central Indiana Land Trust names nature preserve to honor Efroymson family

Central Indiana Land Trust names nature preserve to honor Efroymson family

Select Wings Etc. locations offering free entrée on Veterans Day

Select Wings Etc. locations offering free entrée on Veterans Day

Tips for Carbon Monoxide Awareness Month

Tips for Carbon Monoxide Awareness Month

FSSA statement on SNAP benefits, one week delay

FSSA statement on SNAP benefits, one week delay

Gov. Braun orders flags to half-staff in honor of former Vice President Dick Cheney

Gov. Braun orders flags to half-staff in honor of former Vice President Dick Cheney

Indiana Grown Holiday Box highlights local businesses for the third year

Indiana Grown Holiday Box highlights local businesses for the third year

Christmas Nights of Lights returns to the Indiana State Fairgrounds

Christmas Nights of Lights returns to the Indiana State Fairgrounds

Indiana State Police wants everyone to stay safe this Halloween

Indiana State Police wants everyone to stay safe this Halloween

Nominations being accepted for Indiana Certified Crop Adviser (CCA) of the Year

Nominations being accepted for Indiana Certified Crop Adviser (CCA) of the Year

BMV warns customers of new scam text messages

BMV warns customers of new scam text messages

National FFA Convention & Expo to call Indy home through 2040

National FFA Convention & Expo to call Indy home through 2040