Last week, Congressman Rudy Yakym (IN-02) penned an op-ed for The Washington Times supporting the extension of the 2017 Tax Cuts and Jobs Act (TCJA).

In the piece, Rep. Yakym rebuts common myths about the 2017 tax reforms, namely that they benefited only the wealthy, and offers clear, data-backed arguments showing how these cuts simplified the tax code, boosted wages, empowered parents through an expanded Child Tax Credit, and kept American businesses competitive globally. He also outlines the real consequences to families if Congress allows these cuts to expire.

Read the op-ed here and below.

Tax cuts. Two words that excite Americans across the board. Now, add one more word—Trump—and suddenly, nearly half of the country opposes them. As a House Ways and Means Committee member, I’ve heard all the arguments. So, let’s break it down.

In 2017, President Trump signed the Tax Cuts and Jobs Act—the most significant tax reform in a generation. Opponents of extending the Trump Tax Cuts, particularly Democrats whose approval ratings are floundering at just 29%, have chosen to spread the false narrative that the Trump Tax Cuts only benefited the wealthy. That’s simply not true. Let’s look at the facts.

The Trump Tax Cuts provided a tax cut to most Americans, including 91% of middle-class taxpayers. In fact, the top 10% now pay over 75% of all income taxes, while the bottom half of earners keep more of their money than ever before.

They also delivered simplicity – 94% of taxpayers in my district take the standard deduction now, compared to 80% before the Trump Tax Cuts. That means no more scrambling to find receipts, taxpayers can instead take the standard deduction—a fixed amount set by the government—streamlining the filing process.

The Trump Tax Cuts are pro-worker and pro-family. After President Trump signed the tax cuts into law, companies announced hourly wage increases and bonuses—benefits that Nancy Pelosi dismissed as “crumbs.” But for hardworking Hoosiers, that’s real money. The cuts also doubled the child tax credit, ensuring that parents can afford the ever-rising cost of raising a family.

Finally, the Trump Tax Cuts delivered pro-growth business tax reform. It cut taxes for small businesses and spurred capital investments. Under President Obama, we saw a wave of companies moving their headquarters abroad through corporate inversions. Since the Trump Tax Cuts, there have been no inversions. Instead, American companies have become buyers of foreign competitors.

Here’s the problem: these tax cuts will expire this year without congressional action.

Letting them expire will hit hardworking families the worst. A household of four earning around $80,000 would face approximately $1,700 in higher taxes. In my district, 87,000 parents would see their Child Tax Credit cut in half. This is money that people rely on, not mere “crumbs.”

This isn’t about partisan politics. It’s about economic reality. American families need relief—not more financial strain. Extending the Trump Tax Cuts isn’t just good policy; it’s essential for protecting the financial well-being of millions of hardworking Americans.

Indiana AG reminds Hoosiers to be alert to signs of human trafficking

Indiana AG reminds Hoosiers to be alert to signs of human trafficking

Fairview Park receives OCRA grant to rehab water system

Fairview Park receives OCRA grant to rehab water system

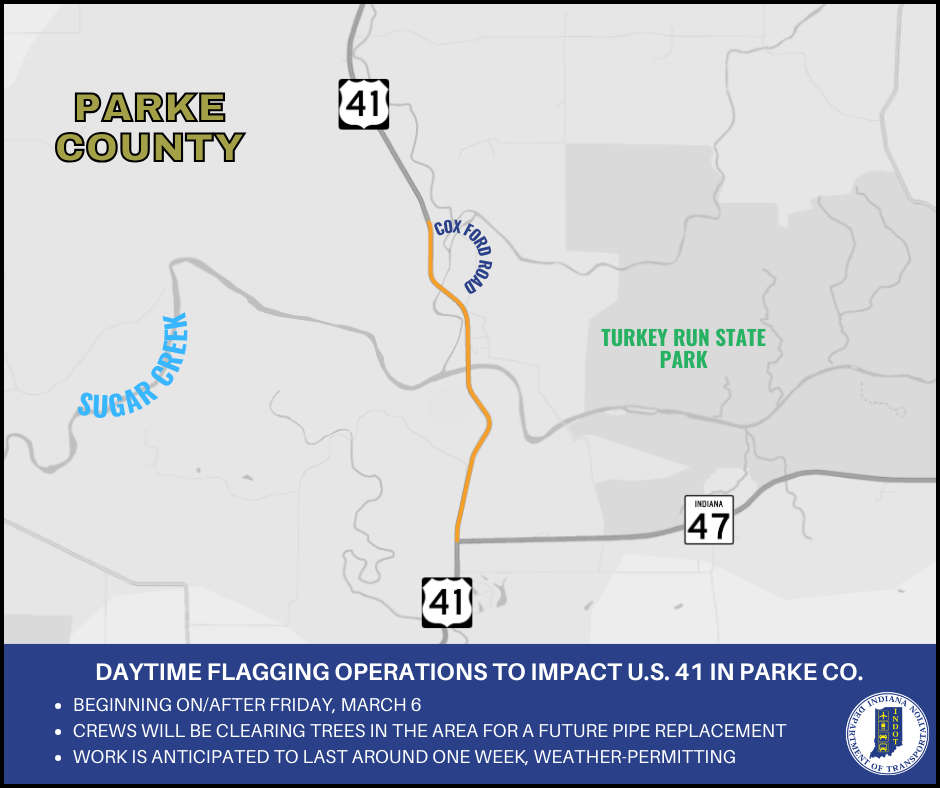

Daytime flagging operations to impact U.S. 41 for tree clearing for a future project

Daytime flagging operations to impact U.S. 41 for tree clearing for a future project

Rosedale man charged with child molesting, soliciting

Rosedale man charged with child molesting, soliciting

Red Cross seeks donations to curb severe blood shortage

Red Cross seeks donations to curb severe blood shortage

Greencastle - Parke Heritage again, South Putnam vs Southmont on GIANT fm Sports

Greencastle - Parke Heritage again, South Putnam vs Southmont on GIANT fm Sports

Bill to increase access to veterinarians signed into law

Bill to increase access to veterinarians signed into law

INDOT implements new roadway worker safety initiative: Project Greenlight

INDOT implements new roadway worker safety initiative: Project Greenlight

Southwest Parke schools synchronous e-learning on Wednesday

Southwest Parke schools synchronous e-learning on Wednesday

Chase Edward Bennett, 17, of Hillsdale

Chase Edward Bennett, 17, of Hillsdale

Riverton Parke student-athlete dies in automobile crash

Riverton Parke student-athlete dies in automobile crash

USDA announces enrollment period for Farmer Bridge Payments

USDA announces enrollment period for Farmer Bridge Payments

Heritage Christian ready for 'good matchup' against Parke Heritage

Heritage Christian ready for 'good matchup' against Parke Heritage

Gov. Braun Launches READI 2.0 Arts & Culture Initiative

Gov. Braun Launches READI 2.0 Arts & Culture Initiative

Brazil woman sentenced in overdose death of Greencastle man

Brazil woman sentenced in overdose death of Greencastle man