Lawrence County has been issued a tenative property assessment equalization factor of 1.000 according to the Illinois Department of Revenue.

The factor is often called the "multiplier". It is the method used to achieve uniform property assessments among counties, as required by law. State law requires property in Illinois to be assessed at 1/3 of its market value. Farm property in Illinois is assessed differently. Assessments here in Lawrence County at at 33.74% of market values, based on sales of properties in 2020, 2021 and 2022.

The factor currently being assigned to Lawrence County is for 2023 taxes payable in 2024. Last year, the equalization factor for the county was also 1.000.

Vermillion County DCS worker facing felonies

Vermillion County DCS worker facing felonies

One week left to file for office in Indiana

One week left to file for office in Indiana

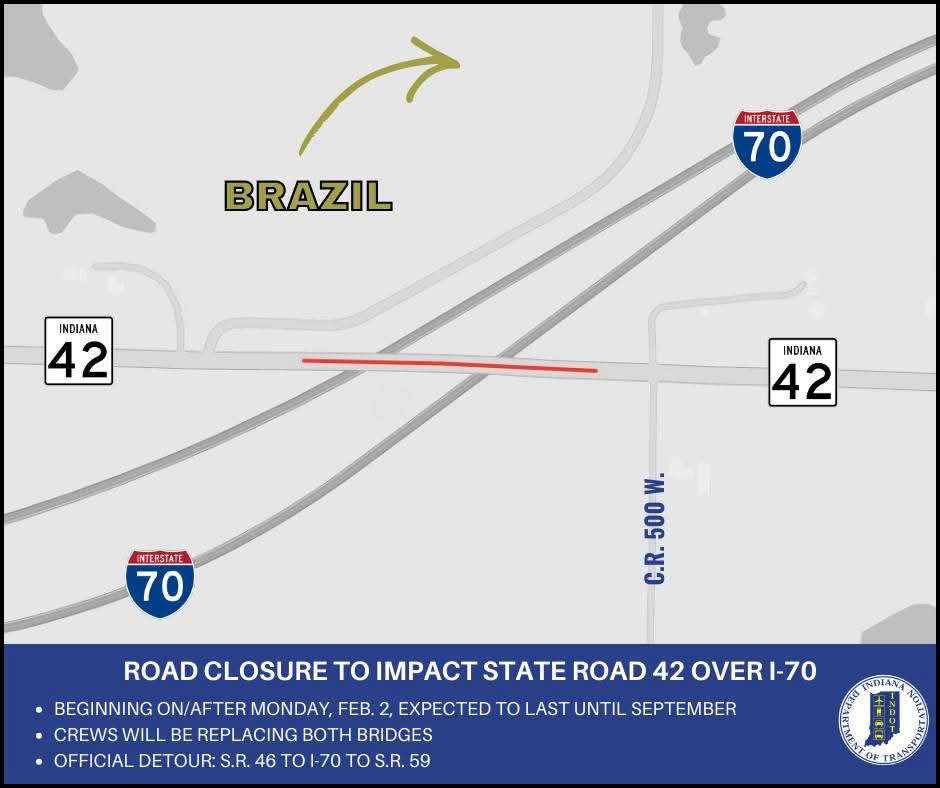

Bridge closures to impact State Road 42 over I-70 in Clay County

Bridge closures to impact State Road 42 over I-70 in Clay County

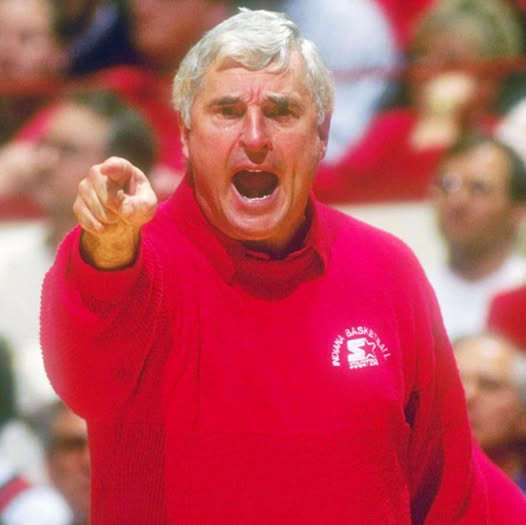

Road renaming resolution co-authored by Criswell to honor Bobby Knight passes House

Road renaming resolution co-authored by Criswell to honor Bobby Knight passes House

Thrive West Central to host Utility Workshop

Thrive West Central to host Utility Workshop

Greene Realty continues to grow

Greene Realty continues to grow

World Food Championships set for 2026 Indianapolis return

World Food Championships set for 2026 Indianapolis return

SW Parke Community Schools looking at Revision Project

SW Parke Community Schools looking at Revision Project

NWS extends Winter Storm Warning to Monday morning

NWS extends Winter Storm Warning to Monday morning

IDHS activates State Emergency Operations Center in response to winter storm

IDHS activates State Emergency Operations Center in response to winter storm

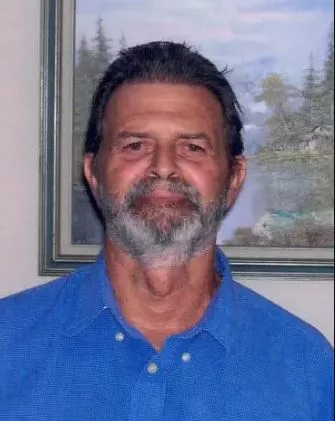

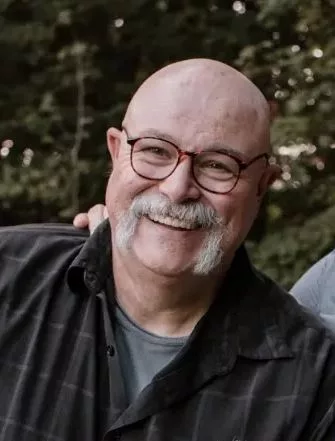

Scholarship Fund honors former Coach Blank

Scholarship Fund honors former Coach Blank

Winter Storm Watch in effect for the weekend, heavy snow possible

Winter Storm Watch in effect for the weekend, heavy snow possible

ISP releases Human Trafficking Awareness Initiative results

ISP releases Human Trafficking Awareness Initiative results

Indiana House Page Program available during 2026 session

Indiana House Page Program available during 2026 session

Indiana State Police seeks volunteer chaplains to support trooper wellness and resilience

Indiana State Police seeks volunteer chaplains to support trooper wellness and resilience

American Red Cross urges the public to donate blood

American Red Cross urges the public to donate blood