INvestABLE Indiana, the state’s ABLE savings and investment program, has surpassed $30 million in assets under management, marking a major milestone and reflecting strong growth driven by expanded eligibility and increased awareness among Hoosiers.

As of January 22, 2026, INvestABLE Indiana holds over $31.2 million in total assets, representing a 38% increase in overall assets year over year. The program also increased new accounts by over 200% compared to the same period last year.

Between January 1 and 22, 2026, INvestABLE Indiana welcomed 80 new enrollments and $176,626.37 in assets from new accounts. This is a dramatic leap from the same period in 2025, when just 26 new enrollments and $84,184.44 in new assets were recorded. The surge is largely attributed to expanded eligibility, which now empowers more Hoosiers—including veterans and those who acquire disabilities later in life—to benefit from an ABLE account. The result: more individuals than ever are securing their financial futures through INvestABLE Indiana.

“This milestone shows what’s possible when we remove barriers and give Hoosiers the tools they need to plan for the future,” said Treasurer of State Daniel Elliott. “INvestABLE Indiana empowers individuals with disabilities—and their families—to save with confidence, knowing their hard-earned dollars are protected while maintaining access to critical benefits. The strong growth we’re seeing confirms that expanding eligibility was the right move for Hoosiers across our state.”

INvestABLE Indiana offers individuals with disabilities and their families a secure pathway to save and invest for disability-related expenses—without risking access to essential means-tested benefits like Supplemental Security Income (SSI) or Medicaid. Account earnings grow tax-deferred, and withdrawals remain tax-free when used for Qualified Disability Expenses (QDEs), maximizing every dollar saved.

Qualified Disability Expenses cover any cost related to the account owner’s disability that enhances health, independence, or quality of life. Across Indiana, participants are leveraging INvestABLE accounts for vital needs: from home purchases and vehicle maintenance to travel, education, and long-term financial stability.

Indiana residents can also benefit from a state tax credit equal to 20% of their contributions—up to $500 per year—making INvestABLE Indiana even more accessible and impactful for families seeking to build lasting financial security.

For more information about INvestABLE Indiana or to open an account, visit in.savewithable.com.

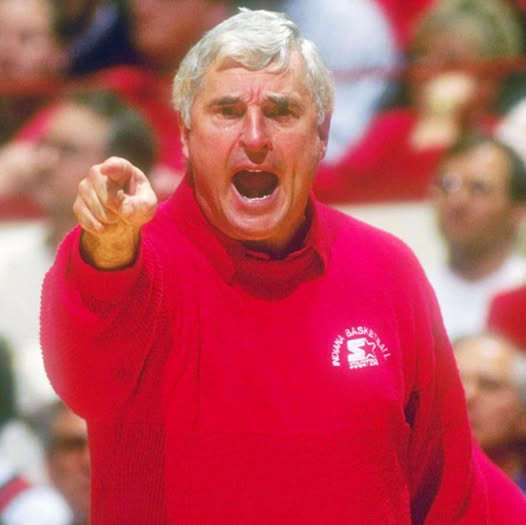

Road renaming resolution co-authored by Criswell to honor Bobby Knight passes House

Road renaming resolution co-authored by Criswell to honor Bobby Knight passes House

Thrive West Central to host Utility Workshop

Thrive West Central to host Utility Workshop

Greene Realty continues to grow

Greene Realty continues to grow

Parke County Commissioners, Amish agree to new road use fee rate

Parke County Commissioners, Amish agree to new road use fee rate

World Food Championships set for 2026 Indianapolis return

World Food Championships set for 2026 Indianapolis return

SW Parke Community Schools looking at Revision Project

SW Parke Community Schools looking at Revision Project

NWS extends Winter Storm Warning to Monday morning

NWS extends Winter Storm Warning to Monday morning

IDHS activates State Emergency Operations Center in response to winter storm

IDHS activates State Emergency Operations Center in response to winter storm

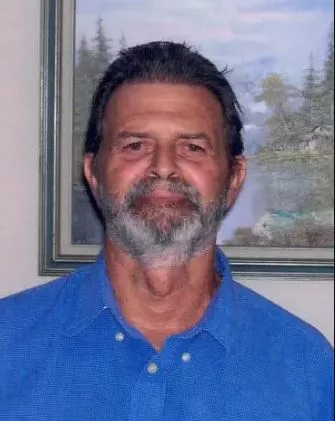

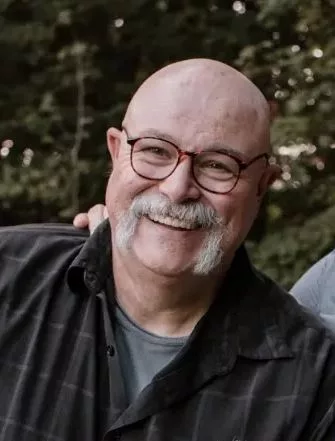

Scholarship Fund honors former Coach Blank

Scholarship Fund honors former Coach Blank

Winter Storm Watch in effect for the weekend, heavy snow possible

Winter Storm Watch in effect for the weekend, heavy snow possible

ISP releases Human Trafficking Awareness Initiative results

ISP releases Human Trafficking Awareness Initiative results

Indiana House Page Program available during 2026 session

Indiana House Page Program available during 2026 session

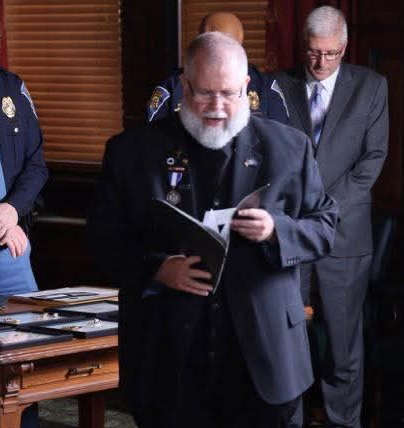

Indiana State Police seeks volunteer chaplains to support trooper wellness and resilience

Indiana State Police seeks volunteer chaplains to support trooper wellness and resilience

American Red Cross urges the public to donate blood

American Red Cross urges the public to donate blood

Rheese Benjamin finishes 8th at wrestling state finals

Rheese Benjamin finishes 8th at wrestling state finals

USDA launches Lender Lens Dashboard to promote data transparency

USDA launches Lender Lens Dashboard to promote data transparency

Cancer Action Day at the Indiana Statehouse: Advocates call for legislation to reduce the burden of cancer

Cancer Action Day at the Indiana Statehouse: Advocates call for legislation to reduce the burden of cancer