Local taxes have been a major topic with Indiana legislators this year. While state property tax remains nationally competitive, dramatic increases on many Hoosiers 2025 property tax assessment have many community members on alert.

Fulton County Assessor Kasey Lee said people in Fulton County are also beginning to take notice. The primary function of the assessor's office is to assess the value of real and personal property. State property taxes are collected by the local county treasurers, based on assessments that are provided by the county assessors. All assessments are based on guidelines and regulations set by state legislators and adopted by the Indiana Department of Local Government Finance.

Lee said normally her office rarely sees visitors from the public. In the past few weeks since the 2025 property tax assessment was issued, however, Lee said she's been speaking with between 40-45 people a day about their concerns on the increase of their property value. Lee said she welcomes anyone who has questions about their recent property assessments to reach out to her office at 574-223-2801.

"They elected me to pay attention to what is happening and help the community, and I love being able to help people," Lee said. "People are upset right now about the increases to their property this year and they want to be heard, and I totally welcome that. The changes are out of our control. I don't mind sitting down to answer questions and educate community members on recent changes that are happening at a state level, not a local level."

Governor Mike Braun's significant tax reform that aims to reduce the growth of property tax bills means some big changes in 2025 property assessments, with an average assessed value increase of 11.7 percent or more. This increase could mean Hoosier homeowners will see a moderate to large tax increase in the 5-10 percent range and even greater in certain situations.

"I have tried reaching out to Governor Braun for a discussion about the changes and what it means for people in rural areas like Fulton County. I have not had a response yet. The cost per square foot in Indiana was increased 30 percent statewide. While I do unfortunately not have any control over the increases, I do encourage anyone with any questions to come in and let me explain their assessments so they can decide whether or not they want to appeal."

Lee said property owners have until June 15 to appeal their 2025 property assessment. In the meantime, Lee is trying to educate community members as much as she can with mobile office hours.

"I came up with the idea of a mobile office a few years ago and it wasn't initially super popular. Last year, I think six people visited my mobile office. This year I am expecting more. What I do is go out in the community and park for around four hours at outside locations. I figured, I'm already out in the community when I'm doing my assessments, why not just bring my office," Lee said.

May primary ballots set for Vermillion County

May primary ballots set for Vermillion County

SW Parke identifies 'Big Five' themes for Revision Project

SW Parke identifies 'Big Five' themes for Revision Project

Lucas Oil named title partner of 500 Festival Parade

Lucas Oil named title partner of 500 Festival Parade

Applications open for new United Way of Central Indiana initiative to build community solutions

Applications open for new United Way of Central Indiana initiative to build community solutions

Utilities District of Western Indiana REMC announces increases over next three years

Utilities District of Western Indiana REMC announces increases over next three years

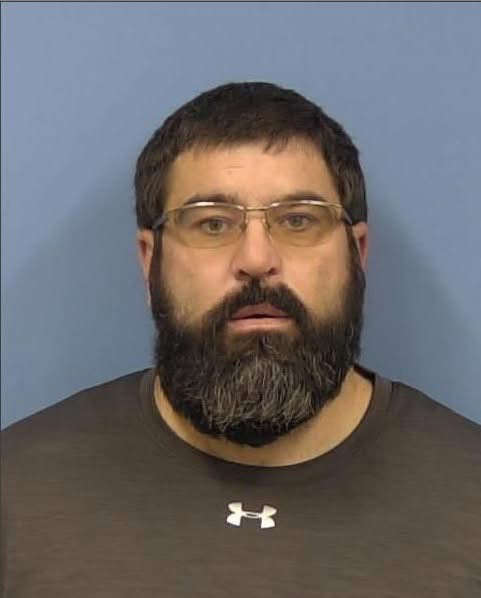

Fountain County man arrested on sex crime charges, Parke County investigation remains

Fountain County man arrested on sex crime charges, Parke County investigation remains

Friday is National Wear Red Day

Friday is National Wear Red Day

Vermillion County DCS worker facing felonies

Vermillion County DCS worker facing felonies

One week left to file for office in Indiana

One week left to file for office in Indiana

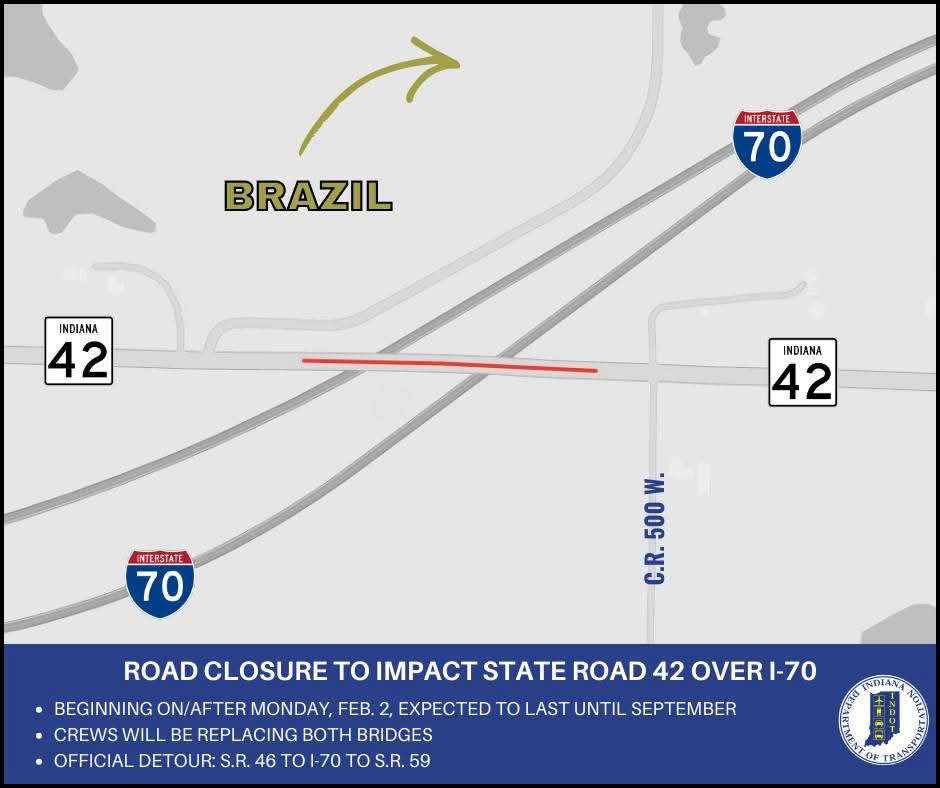

Bridge closures to impact State Road 42 over I-70 in Clay County

Bridge closures to impact State Road 42 over I-70 in Clay County

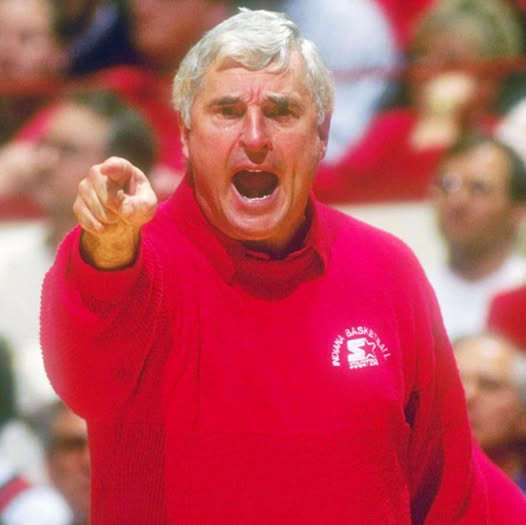

Road renaming resolution co-authored by Criswell to honor Bobby Knight passes House

Road renaming resolution co-authored by Criswell to honor Bobby Knight passes House

Thrive West Central to host Utility Workshop

Thrive West Central to host Utility Workshop

Greene Realty continues to grow

Greene Realty continues to grow

World Food Championships set for 2026 Indianapolis return

World Food Championships set for 2026 Indianapolis return

NWS extends Winter Storm Warning to Monday morning

NWS extends Winter Storm Warning to Monday morning

IDHS activates State Emergency Operations Center in response to winter storm

IDHS activates State Emergency Operations Center in response to winter storm