As part of legislation approved by the General Assembly and signed into law by the Governor in 2025, the homestead standard and supplemental deductions were revised. Homeowners who already receive the homestead deduction do not need to refile an application to receive the updated benefits.

“As administrators of the property tax system, county officials want to make sure taxpayers are aware of and take advantage of these property tax changes,” said David Bottorff, Executive Director of the Association of Indiana Counties.

The revised supplemental homestead deduction will continue to increase annually through 2031, at which time 66.7% of a homestead’s assessed value will be deducted as non-taxable. As a result, only one-third of a homestead’s assessed value (market value) will ultimately be used to calculate property taxes. In addition, qualifying homesteads will receive an additional 10% credit, up to $300, applied to their 2026 property tax bill. Homeowners who currently receive the homestead deduction will automatically qualify for this new supplemental homestead credit.

Property owners who purchased a home in 2025, refinanced, or experienced a change in ownership or title are encouraged to confirm that their homestead deduction has been properly applied. This can be done by reviewing the county’s property tax website or by contacting the county auditor’s office.

As part of these changes, some existing property tax deductions will be converted to property tax credits beginning in 2026. Property tax deductions reduce taxable assessed value, while credits are applied as a dollar amount that directly reduces the property tax bill.

For qualifying seniors who previously received the over-65 deduction or the blind or disabled deduction (each requiring a separate application), those benefits will convert to dollar credits on the 2026 property tax bill.

Eligibility requirements were expanded to allow more individuals to qualify for the $150 over-65 credit. The adjusted gross income limit is $60,000 for single filers and $70,000 for joint filers. Proof of age and income verification are required as part of the application process.

The blind or disabled credit is $125. Income limitations have been removed for this credit; however, applicants must provide documentation verifying blind or disabled status when filing.

To receive applicable deductions and credits on 2026 property tax bills, newly eligible property owners, recently purchased a home, or experienced a change in eligibility must file the appropriate application with the county auditor by Jan. 15.

Property owners already receiving qualifying deductions do not need to reapply and will receive the new credits automatically.

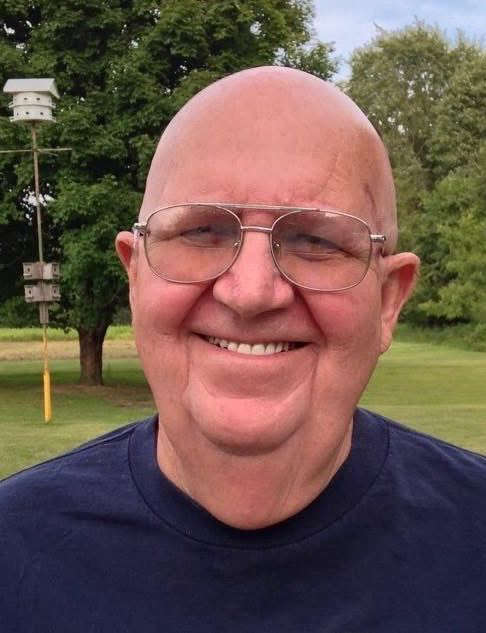

Man wanted on multiple warrants apprehended in Plymouth

Man wanted on multiple warrants apprehended in Plymouth

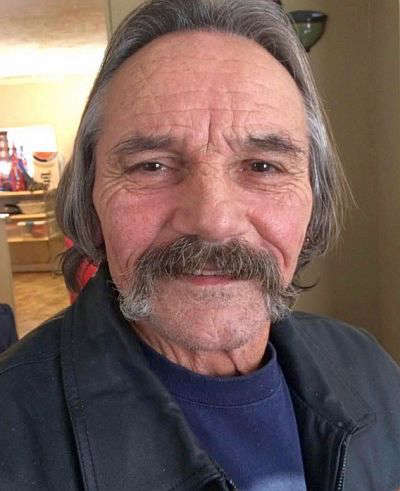

Plymouth man faces resisting arrest, suspended license charges after traffic stop

Plymouth man faces resisting arrest, suspended license charges after traffic stop

Plymouth teen arrested after domestic dispute, altercation with police and hospital staff

Plymouth teen arrested after domestic dispute, altercation with police and hospital staff

Young & colleagues introduce America’s Living Library Act

Young & colleagues introduce America’s Living Library Act

Attorney General issues statement on Governor Mike Braun signing FAIRNESS Act into law

Attorney General issues statement on Governor Mike Braun signing FAIRNESS Act into law

Yakym announces 2026 Congressional Art Competition

Yakym announces 2026 Congressional Art Competition

Indiana earns top credit rating from major agency

Indiana earns top credit rating from major agency

Heartland Art Center relocates to One More Chapter Books during building renovation

Heartland Art Center relocates to One More Chapter Books during building renovation