U.S. Senators Todd Young (R-Ind.) and Amy Klobuchar (D-Minn.) introduced two pieces of legislation to help more Americans launch and expand small businesses by improving the Small Business Administration’s (SBA) “504” loan program.

The 504 Credit Risk Management Improvement Act of 2025, led by Young, would increase and streamline oversight of the 504 loan program, allowing for greater accountability and efficiency.

The 504 Modernization and Small Manufacturer Enhancement Act, led by Klobuchar, would update the loan guarantee program and enhance small manufacturers’ ability to access affordable capital. The SBA’s 504 loan guarantee program provides small businesses with long-term fixed-rate financing for major assets including, land, equipment, and machinery.

“Small businesses create about two-thirds of new American jobs and generate nearly half of all U.S. economic activity. Our bills will strengthen the SBA’s 504 loan program, which provides access to affordable capital and continues to generate tens of millions in expansion financing in Indiana,” said Senator Young.

“The 504 loan program helps provide small businesses with the resources they need to create the jobs of tomorrow,” said Senator Klobuchar. “By making key improvements to expand eligibility and increase access to capital, our bipartisan legislation will ensure that more small businesses, including small manufacturers, can access and benefit from this loan program.”

After being introduced in 2023, both pieces of legislation passed the Senate Committee on Small Business and Entrepreneurship.

Full text of the 504 Credit Risk Management Improvement Act can be found here. Full text of the 504 Modernization and Small Manufacturer Enhancement Act can be found here.

ISP Commercial Vehicle Enforcement Division Statistics

ISP Commercial Vehicle Enforcement Division Statistics

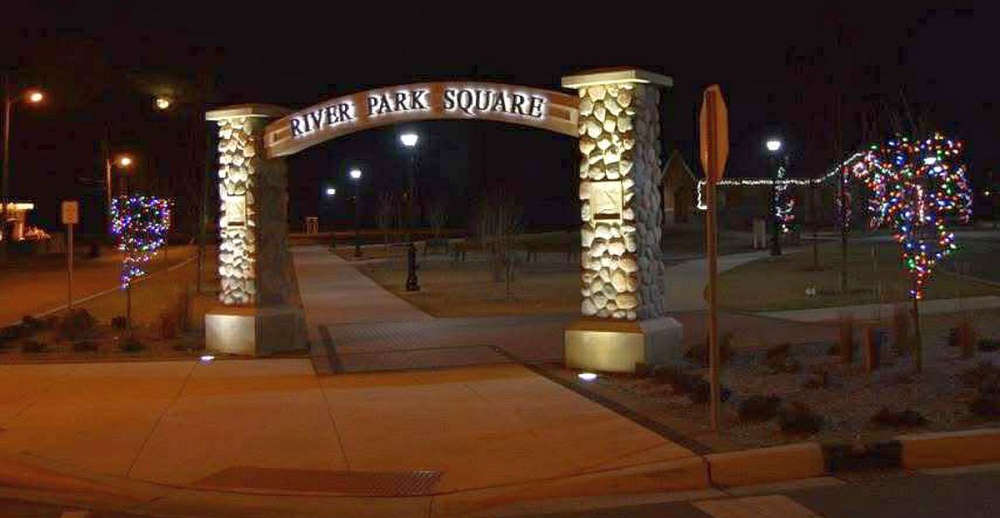

IN Reps. Jordan & Teska to appear at Third House Wednesday with Senator Bohacek

IN Reps. Jordan & Teska to appear at Third House Wednesday with Senator Bohacek

Indiana is Open for Business: February’s Jobs and Wages Wins

Indiana is Open for Business: February’s Jobs and Wages Wins

Plymouth Mayor announces Free Summer Concert Series Lineup

Plymouth Mayor announces Free Summer Concert Series Lineup

Risen movie March Seasoned Citizen Matinee at The REES

Risen movie March Seasoned Citizen Matinee at The REES

U.S. Senator Young: Resolution Recognizing CTE Month passes senate

U.S. Senator Young: Resolution Recognizing CTE Month passes senate

NIPSCO offers Winter Bill Support through March 31

NIPSCO offers Winter Bill Support through March 31

Marshall County man sentenced to 11½ years for firearm possession, drug-related driving

Marshall County man sentenced to 11½ years for firearm possession, drug-related driving