U.S. Senator Todd Young (R-Ind.) joined with Republicans on the Senate Finance Committee in reintroducing a bill to prevent the Internal Revenue Service (IRS) from using its $80 billion infusion of taxpayer dollars included in the Inflation Reduction Act (IRA) to squeeze more revenue out of hardworking taxpayers who earn less than $400,000 per year.

“Our bill would prevent the IRS from using its new funding to increase enforcement on Hoosier families and small businesses making less than $400,000 per year,” said Senator Young.

Estimates from the Congressional Budget Office confirmed increased audits would result in billions of dollars in additional revenue being collected from working Americans. Other estimates from the non-partisan Joint Committee on Taxation have shown a large portion of uncollected tax revenue comes from small businesses and sole proprietors, many of whom make less than $400,000 per year. The legislation, which Senate Finance Committee Republicans also introduced in the 117th Congress, would codify the Treasury Secretary’s unenforceable pledge to not use IRA funding to increase audits on anyone making less than $400,000 per year.

The bill is co-sponsored by all Senate Finance Committee Republicans.

You can find the full bill text here.

ISP Commercial Vehicle Enforcement Division Statistics

ISP Commercial Vehicle Enforcement Division Statistics

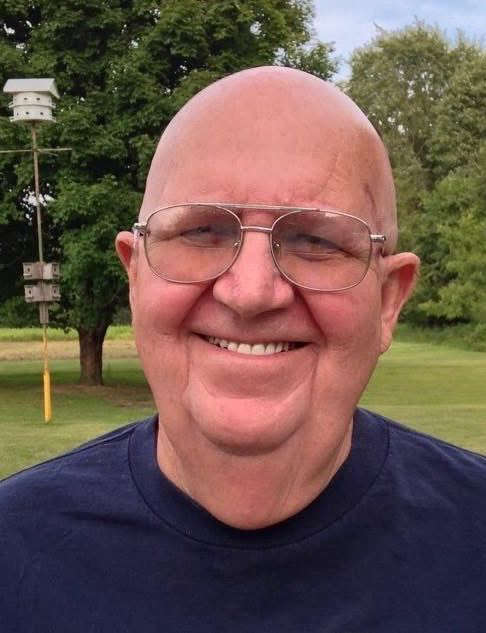

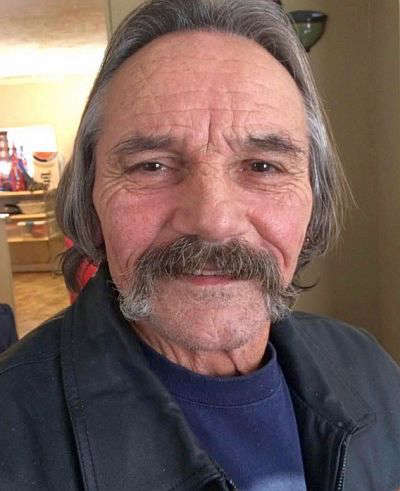

IN Reps. Jordan & Teska to appear at Third House Wednesday with Senator Bohacek

IN Reps. Jordan & Teska to appear at Third House Wednesday with Senator Bohacek

Indiana is Open for Business: February’s Jobs and Wages Wins

Indiana is Open for Business: February’s Jobs and Wages Wins

Marshall County man sentenced to 11½ years for firearm possession, drug-related driving

Marshall County man sentenced to 11½ years for firearm possession, drug-related driving

Two Republican candidates removed from May Primary Ballot over voting requirements

Two Republican candidates removed from May Primary Ballot over voting requirements

Plymouth School Board meeting Tuesday evening at 6

Plymouth School Board meeting Tuesday evening at 6

Chicago woman arrested on drug charge after traffic stop

Chicago woman arrested on drug charge after traffic stop

Man killed in Fulton County hunting accident

Man killed in Fulton County hunting accident