Lawrence County has been issued a tenative property assessment equalization factor of 1.000 according to the Illinois Department of Revenue.

The factor is often called the "multiplier". It is the method used to achieve uniform property assessments among counties, as required by law. State law requires property in Illinois to be assessed at 1/3 of its market value. Farm property in Illinois is assessed differently. Assessments here in Lawrence County at at 33.74% of market values, based on sales of properties in 2020, 2021 and 2022.

The factor currently being assigned to Lawrence County is for 2023 taxes payable in 2024. Last year, the equalization factor for the county was also 1.000.

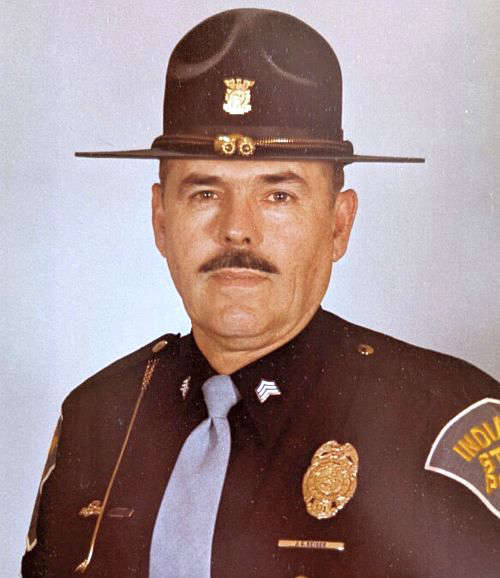

One week left to file for office in Indiana

One week left to file for office in Indiana

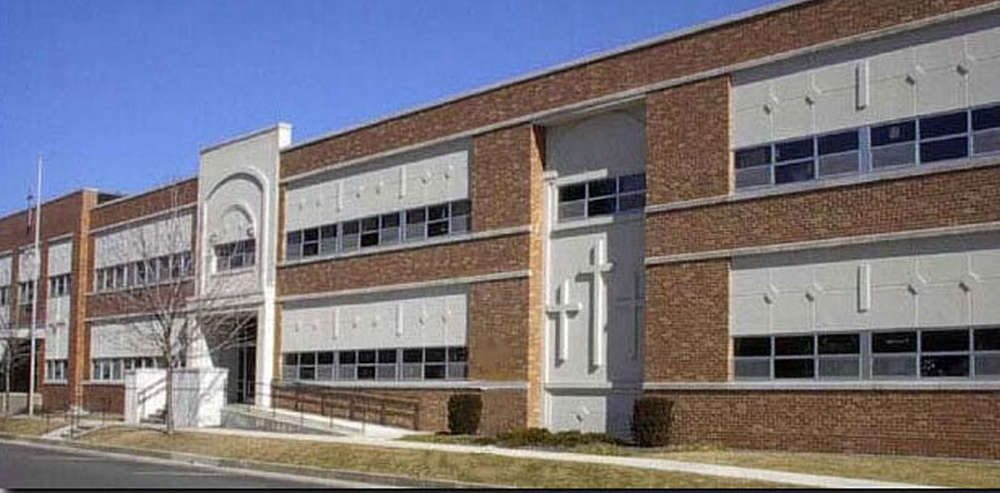

St. Michael Catholic School Conducts Safety Investigation After Suspicious Item Found

St. Michael Catholic School Conducts Safety Investigation After Suspicious Item Found

During National School Choice Week, parents can celebrate and defend their fundamental right to raise and educate their own children

During National School Choice Week, parents can celebrate and defend their fundamental right to raise and educate their own children

Marshall County Regional Sewer District holds final meeting before dissolution

Marshall County Regional Sewer District holds final meeting before dissolution

Marshall County Commissioners approve appointments, security upgrades, & purchase for Weights & Measures

Marshall County Commissioners approve appointments, security upgrades, & purchase for Weights & Measures

Plymouth City Council advances ordinance to charge residential facilities for non-emergency calls

Plymouth City Council advances ordinance to charge residential facilities for non-emergency calls

Road renaming resolution co-authored by Criswell to honor Bobby Knight passes House

Road renaming resolution co-authored by Criswell to honor Bobby Knight passes House

Bremen teen arrested for driving without license following traffic stop

Bremen teen arrested for driving without license following traffic stop