News

Monday evening the Plymouth Common Council accepted Tax Incremental Finance (TIF) Compliance Forms from three industries.

City Attorney jeff Houin told the council three companies, Farm Innovators, Riverside Commons and Complexus Medical each have real property tax abatements and Complexus Medical also has a personal property tax abatement.

Each year companies that have been granted a tax abatement from the City of Plymouth must submit annual compliance through a CF1 form. The form includes their expected investment and employment results as well as the assessed values. During the term of the abatement, they are required to file annually their current standings.

City Council members had no questions and motioned to approve the CF1 forms saying that each company showed substantial compliance with their projections.

Indiana AG reminds Hoosiers to be alert to signs of human trafficking

Indiana AG reminds Hoosiers to be alert to signs of human trafficking

Red Cross seeks donations to curb severe blood shortage

Red Cross seeks donations to curb severe blood shortage

Purdue Extension to present Agricultural Tax and Policy Workshop

Purdue Extension to present Agricultural Tax and Policy Workshop

U.S. Senator Young participates in Tax Reform Roundtable in Fort Wayne

U.S. Senator Young participates in Tax Reform Roundtable in Fort Wayne

Recent arrests serve as reminder to Hoosiers to be alert to signs of human trafficking

Recent arrests serve as reminder to Hoosiers to be alert to signs of human trafficking

Plymouth Park Board approves 6-year Blueberry Festival agreement

Plymouth Park Board approves 6-year Blueberry Festival agreement

ISP Commercial Vehicle Enforcement Division Statistics

ISP Commercial Vehicle Enforcement Division Statistics

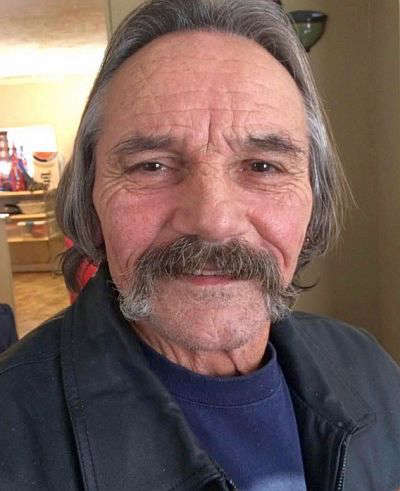

Local business owner receives grant to renovate east side car wash

Local business owner receives grant to renovate east side car wash