SEA 1: Why Homeowners Deserve Property Tax Relief

Senate Enrolled Act 1 (SEA 1) of the 2025 session was the most significant overhaul of Indiana’s property taxes and local government finance system in a generation. Although the law presents challenges for local units of government, it also advances important goals: greater transparency, increased accountability, and a more equitable tax structure.

Prior to SEA 1, Indiana’s income tax laws often provided revenue to local units without requiring those units to take a public vote on the tax. Local governments were also unintentionally rewarded for maintaining property-tax-funded debt and increasing levies, since doing so generated higher property tax collections and a larger share of income tax distributions. SEA 1 addresses these longstanding issues by capping and constraining debt issuance and requiring more units to hold public meetings before establishing or increasing local income tax rates.

Even before SEA 1, counties demonstrated a long history of prudent fiscal management. County governments uniquely provide essential services not only to residents but also to every other local unit of government. County officials serve as both collectors and distributors of local taxes. This responsibility gives counties a detailed understanding of their communities’ financial pressures and a clear picture of how policy changes affect taxpayers and the units relying on county-distributed revenues.

Understanding Property Tax Levies and Debt Service Levies

Property tax levies are the total amount local units of government may collect through property taxes to fund its annual operations and public services.

Debt service levies are taxes imposed to repay money borrowed for capital projects or other obligations. These levies are calculated annually to ensure a unit meets its legally required debt payments.

From 2019 to 2025, county property tax levies experienced the smallest year-to-year growth among major unit types, except for libraries. Debt service levies followed a similar pattern: county debt service growth remained consistently below the statewide average for other local unit types.

Why Homeowners Needed Immediate Relief

A major focus of SEA 1 is providing property tax relief to homeowners, and the need for that relief was clear. In 2012, homeowners paid 42% of all property taxes collected statewide. By 2025, their share had grown to 51%. From 2012 to 2018, residential assessed values increased by less than 4% per year. But beginning in 2019, annual increases exceeded 8%, fueled largely by rapid growth in home market values that far outpaced other property types. As market values surged, the property tax burden shifted disproportionately onto homeowners.

To rebalance the system, SEA 1 phases in an increase to the homeowners’ deduction, ultimately allowing homeowners to deduct 67% of their home’s market value by 2031. At that point, homeowners will pay taxes on only 33% of their home’s assessed value. This phased-in change will gradually shift some of the tax burden back to other property classes, restoring balance to the system.

Moving Forward

As with any generational policy change, aspects of SEA 1 will require continued review and refinement. But its guiding goals to enhance transparency, provide stronger accountability, and more equitable tax structure should remain central to the system going forward. We want to ensure that counties have the funds to provide constitutional and statutory services like the courts, prosecutors, public defenders, jails, elections and maintaining public property records.

The next step in property tax reform is ensuring that when one unit provides tax relief, other units cannot absorb that capacity for their own spending. Under current law, if a unit reduces its levy to provide relief, other units can “claim” that unused tax capacity, undermining the intended benefit to taxpayers. For property owners to truly experience relief, Indiana must ensure that reductions offered by one unit are not offset by increases elsewhere.

Data Source: Indiana Gateway

Elizabeth A. Mallers

Association of Indiana Counties

Director of Communications

Plymouth School Board awards $1.8M bid for PHS Gym renovation

Plymouth School Board awards $1.8M bid for PHS Gym renovation

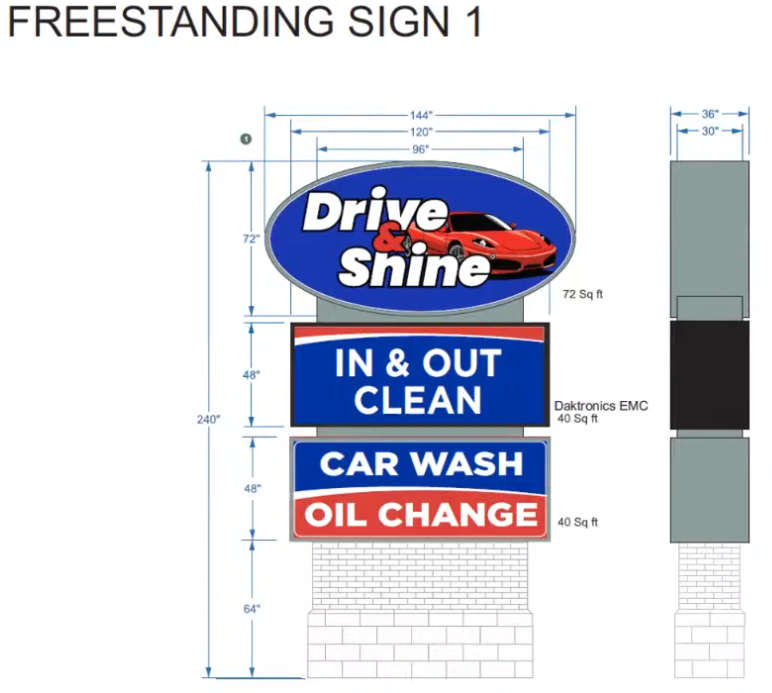

Plymouth BZA approves sign variances for Drive & Shine Car Wash

Plymouth BZA approves sign variances for Drive & Shine Car Wash

Indiana AG reminds Hoosiers to be alert to signs of human trafficking

Indiana AG reminds Hoosiers to be alert to signs of human trafficking

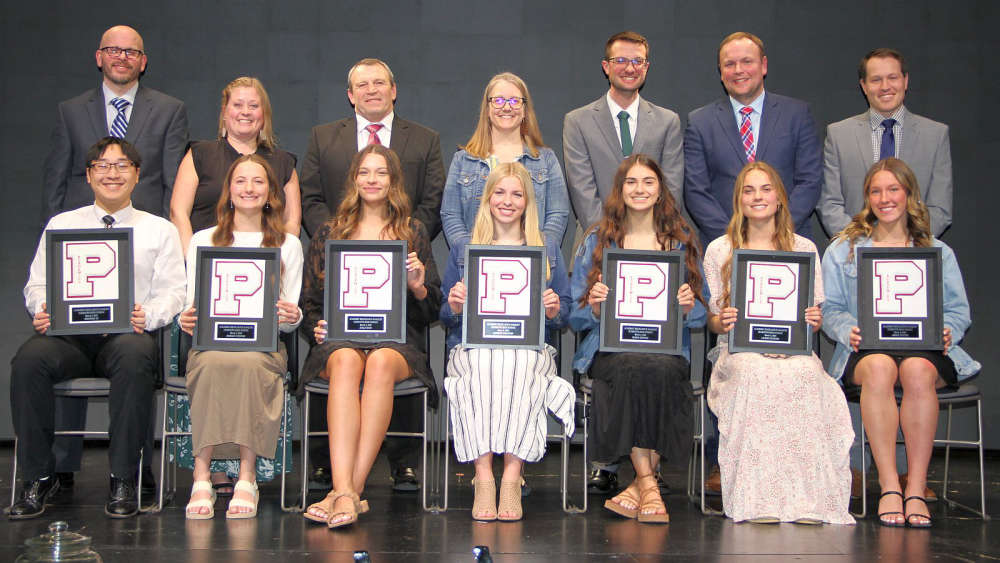

Plymouth High School celebrates academic excellence at annual banquet

Plymouth High School celebrates academic excellence at annual banquet

Bourbon man arrested on child neglect charge

Bourbon man arrested on child neglect charge

Master Trooper James Zeser Retires from the Indiana State Police

Master Trooper James Zeser Retires from the Indiana State Police

Plymouth woman arrested after leaving scene of crash

Plymouth woman arrested after leaving scene of crash

Kennedy’s Kitchen brings Irish flavor to The REES

Kennedy’s Kitchen brings Irish flavor to The REES