Today marks National ABLE Savings Day , and the Indiana State Treasurer’s Office is celebrating with the announcement of a record-breaking fiscal year for INvestABLE Indiana—the state’s ABLE savings program that allows eligible individuals with disabilities to save for qualified expenses without losing certain means-tested benefits.

Closing the 2025 fiscal year, INvestABLE Indiana reports record-setting results in enrollment, assets, and program enhancements—making this one of the most successful years in the program’s history.

In 2025, INvestABLE Indiana’s assets under management surpassed $25.7 million, representing a more than 35% increase over last year. Program enrollment also reached a new high with over 2,400 active accounts—a 20.5% increase from 2024. On average, account owners are now saving nearly $11,000, a dramatic improvement from the previous $2,000 cap for those receiving certain means-tested benefits.

The program celebrated several other key milestones in 2025:

- Program Enhancements – Launched a new entity enrollment platform, streamlining the process for organizations to open and manage accounts for their clients.

- Expanded Eligibility Ahead – Promoted the upcoming federal ABLE eligibility expansion on Jan. 1, 2026, when the age of onset requirement will increase from 26 to 46, making millions more individuals, nationwide, eligible for ABLE accounts.

- Increased Contribution Limits – Annual ABLE account contribution limit rose to $19,000 in 2025 (up from $18,000 in 2024).

- Lower Fees – Reduced annual account maintenance fees by $2, down to $31 for e-statements and $56 for paper statements.

- Investment Options – Introduced a Money Market option, providing another cash-equivalent savings choice with potential for higher returns.

- State Tax Credit – Debuted a 20% Indiana state income tax credit (worth up to $500 annually) for taxpayers contributing to INvestABLE Indiana accounts.

- Partnership Growth – Expanded partnership with Anthem BCBS, which increased its INvestABLE Indiana Value Added Benefit for eligible Hoosier Care Connect members from $25 to $75.

- Community Engagement – Increased statewide trainings, webinars, and resource fair participation, while celebrating the inaugural National ABLE Savings Day on August 14 and the 10th anniversary of the ABLE Act.

As part of the Indiana State Treasurer’s Office, INvestABLE Indiana operates with a commitment to both fiscal responsibility and service to Hoosiers with disabilities. “INvestABLE Indiana is proof that sound financial stewardship and compassion can go hand in hand,” said Indiana State Treasurer Daniel Elliott. “This program not only protects the financial future of Hoosiers with disabilities but also empowers them to dream bigger, save more, and live with greater independence.”

“I could not be prouder of the growth and achievements of INvestABLE Indiana over the past year," said Amy Corbin, Executive Director of INvestABLE Indiana. "All the hard work, community engagement, and responsible fiscal efforts to grow the program are exemplified by the above. It is an honor to bring this life-enhancing tool to all eligible Hoosiers."

About INvestABLE Indiana

To be eligible for an account, the individual must have experienced onset of disability prior to the age of 26 (this will increase to 46 years old on January 1, 2026) and either be entitled to SSI or SSDI or have a doctor’s diagnosis of a significant functional impairment. Indiana taxpayers are eligible for a state income tax credit of 20% of contributions to an INvestABLE Indiana account, up to $500 credit per year. This credit may be subject to recapture from the account owner (not the contributor) in certain circumstances, such as distributions made from an account that is terminated within 12 months, rollovers to another state's ABLE plan, or rollovers to a 529 plan other than a 529 plan established by the State of Indiana. Money can be withdrawn and spent on qualified expenses or INvestABLE Indiana account owners can choose to grow their finances and create long-term savings with tax-free earnings. Contributions and earnings in INvestABLE Indiana accounts are not subject to federal or state income tax if spent on qualified expenses. Contributions are made with post-tax dollars. For more information, visit www.savewithable.com.

Indiana is Open for Business: February’s Jobs and Wages Wins

Indiana is Open for Business: February’s Jobs and Wages Wins

Marshall County man sentenced to 11½ years for firearm possession, drug-related driving

Marshall County man sentenced to 11½ years for firearm possession, drug-related driving

Two Republican candidates removed from May Primary Ballot over voting requirements

Two Republican candidates removed from May Primary Ballot over voting requirements

Plymouth School Board meeting Tuesday evening at 6

Plymouth School Board meeting Tuesday evening at 6

Chicago woman arrested on drug charge after traffic stop

Chicago woman arrested on drug charge after traffic stop

Man killed in Fulton County hunting accident

Man killed in Fulton County hunting accident

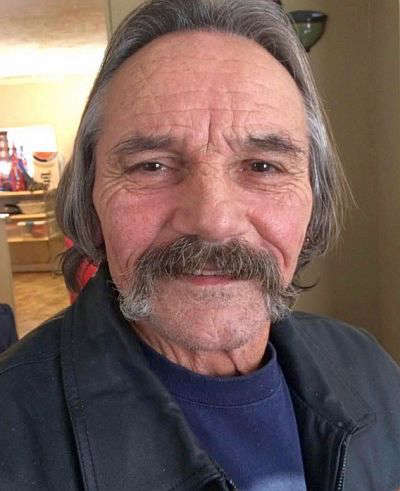

Marshall County man arrested for driving without license

Marshall County man arrested for driving without license

Oak Hill Cemetery announces annual Spring Cleanup

Oak Hill Cemetery announces annual Spring Cleanup