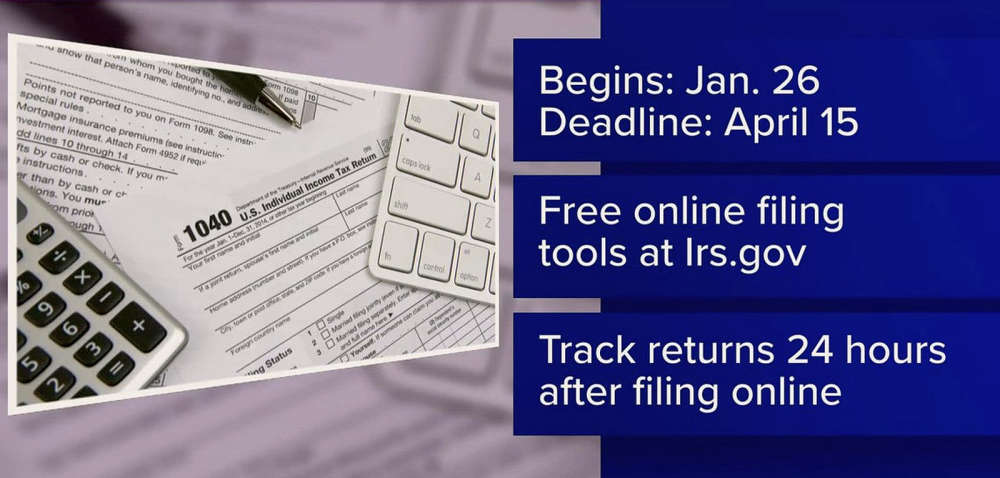

The Indiana Department of Revenue (DOR), along with the IRS, will start accepting filings for 2025 Individual Income tax returns on Monday, Jan. 26, 2026. Unless you are filing an extension, the deadline to file state and federal income tax returns and pay any taxes that are due is Wednesday, April 15, 2026.

DOR urges taxpayers not to file their state tax returns prior to Jan. 26 or before obtaining all required documents. Tax return submissions without proper documentation can result in processing and refund delays. Employers must provide wage statements by Jan. 31.

Taxpayers who file an extension must remember that the extension is for filing only and does not extend the deadline to pay the tax that is due.

DOR encourages taxpayers to use electronic filing, online payments, and direct deposit for faster processing and refunds.

Eligible taxpayers may be able to utilize electronic filing using DOR-approved online tax vendors through the INfreefile program available at www.in.gov/dor/i-am-a/

Additional information on Individual Income taxes, including extensions, late filings, and frequently asked questions, documentation required to file, and filing and payment options, is available at in.gov/dor/i-am-a/individual/.

Taxpayers who wish to contact DOR should use INTIME’s direct messaging feature at intime.dor.in.gov for the most efficient service.

Mercedes-Benz to pay $12.7 million to Indiana and Hoosier consumers to settle allegations of deception regarding vehicle emission controls

Mercedes-Benz to pay $12.7 million to Indiana and Hoosier consumers to settle allegations of deception regarding vehicle emission controls

IN Rep. Jack Jordan: Indiana's graduation rate hits record high

IN Rep. Jack Jordan: Indiana's graduation rate hits record high

Akron man faces OWI, sexual battery charges following Sunday incidents

Akron man faces OWI, sexual battery charges following Sunday incidents

South Bend man arrested by city police, possession of marijuana & DWS

South Bend man arrested by city police, possession of marijuana & DWS

Commissioners meet Tuesday at 9:30 a.m. in County Building

Commissioners meet Tuesday at 9:30 a.m. in County Building

Skip the fancy dinner this Valentine's Day — Paint Your Person instead

Skip the fancy dinner this Valentine's Day — Paint Your Person instead

USDA launches Lender Lens Dashboard to promote data transparency

USDA launches Lender Lens Dashboard to promote data transparency

Cancer Action Day at the Indiana Statehouse: Advocates call for legislation to reduce the burden of cancer

Cancer Action Day at the Indiana Statehouse: Advocates call for legislation to reduce the burden of cancer