.webp)

indiana-s-state-tax-revenue-last-month-well-below-projections

Tax revenue to Indiana’s General Fund tumbled more than 12% below projections last month, according to the latest state revenue report.

The fund took in about $2.7 billion during April, or $393 million less than expected in a December state revenue forecast.

But the fund is still keeping pace year-to-date, with collections $23 million or 0.1% greater than forecasted.

A decline in individual income tax collections contributed to the monthly miss. The state received $1.5 billion instead of $1.8 billion, falling $300 million — or 17% — short of predictions.

In commentary, the State Budget Agency noted that taxpayers have for the last year been adjusting to 2023 legal changes, resulting in “unusual payment timing.”

“Various timing factors impact this month’s withholdings and other individual income tax collections. The below-mentioned performance in withholdings and other individual income tax collections should be interpreted within the perspective of total individual income tax collections and within the fiscal year-to-date trend,” the agency wrote. “These factors are projected to fully normalize over the coming months and month-to-month variations may still occur.”

The state is still $87 million, or 1%, ahead of individual income tax projections year-to-date. Lower corporate tax collections also played a role. The state took in about $201 million, or about 33%, less than anticipated.

“Differences relative to monthly estimates are likely as various factors may impact monthly revenue activity including payment and refund timing, late payments, and more,” the agency wrote. “Corporate tax collections should be interpreted within the fiscal year-to-date trend.”

But year-to-date, they’re still down nearly 12% from expectations.

April is a key month for both individual income and corporate taxes because it’s one of four quarterly deadline months. Year-over-year comparisons in both are complicated by a variety of legal changes, per the agency.

ISP - Human Trafficking Awareness Initiative Results

ISP - Human Trafficking Awareness Initiative Results

Plymouth Community School Corporation student recognized with IASP Reel Impact Award

Plymouth Community School Corporation student recognized with IASP Reel Impact Award

Attorney General endorses legislation to reform post-conviction process, protect victims and restore finality to the justice systemy

Attorney General endorses legislation to reform post-conviction process, protect victims and restore finality to the justice systemy

Governor Braun delivers record economic results in 2025, builds momentum for 2026

Governor Braun delivers record economic results in 2025, builds momentum for 2026

Indiana State Police seeks volunteer chaplains to support trooper wellness and resilience

Indiana State Police seeks volunteer chaplains to support trooper wellness and resilience

Plymouth police chief presents 2025 department activity report

Plymouth police chief presents 2025 department activity report

City departments move forward on 2026 vehicle replacements

City departments move forward on 2026 vehicle replacements

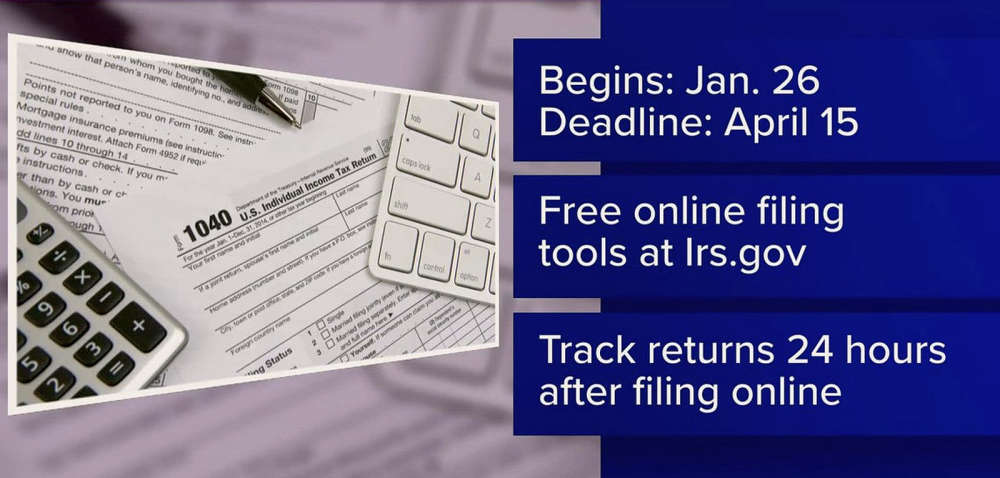

Individual Income tax filings opens Jan. 26

Individual Income tax filings opens Jan. 26