Monday night, the Plymouth Common Council passed on the second and final readings an ordinance implementing a wheel tax with a 6-0 vote.

The tax, which takes effect on January 1, 2026, will cost city residents who own vehicles $25 annually for passenger cars and motorcycles, and $40 annually for heavier vehicles such as trucks, RVs, and trailers. The city council implemented this measure to ensure continued access to state funding through Community Crossings for road projects, as required by House Enrolled Act 1461. While the BMV estimated that the city’s wheel tax generates approximately $275,000 annually for street improvements, the overall impact on the city’s budget is relatively small.

Plymouth drivers will pay slightly more when registering their vehicles starting next year. The wheel tax applies to each vehicle, not each wheel.

With no public comments on the wheel tax, the City Council was under the gun to pass the ordinance before September 1st.

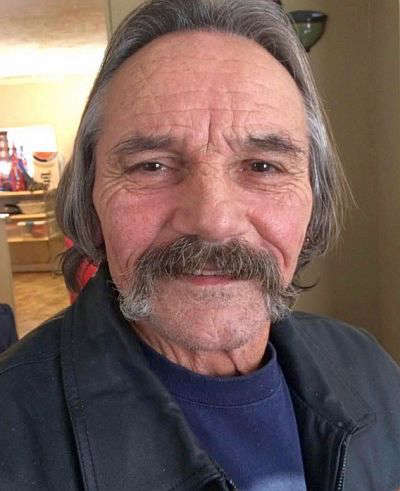

Mayor Robert Listenberger told GIANT fm WTCA that revenues generated from the wheel tax will come to the city throughout the year as individuals and businesses pay their vehicle registrations.

City Attorney Jeff Houin gave a brief explanation of why the council took this step at this time. He stated that in 2024, INDOT awarded nearly $350 million in Community Crossing Grant funds across the state. The previous limit of grant funds was $1.5 million; however, with the changes in legislation, the maximum award was reduced to $1 million, and the total amount available dropped to $100 million.

Houin said in 2027, additional funding will be available to communities that have a wheel tax in place. Of the additional funds, $20 million will be for the Tracks program, and $50 million will be available to the City of Indianapolis if it decides to match the grant award with new money. The remaining amount will be distributed among local governments that have a wheel tax or local option highway user tax in place. The distribution will be based on lane miles.

ISP Commercial Vehicle Enforcement Division Statistics

ISP Commercial Vehicle Enforcement Division Statistics

IN Reps. Jordan & Teska to appear at Third House Wednesday with Senator Bohacek

IN Reps. Jordan & Teska to appear at Third House Wednesday with Senator Bohacek

Indiana is Open for Business: February’s Jobs and Wages Wins

Indiana is Open for Business: February’s Jobs and Wages Wins

Marshall County man sentenced to 11½ years for firearm possession, drug-related driving

Marshall County man sentenced to 11½ years for firearm possession, drug-related driving

Two Republican candidates removed from May Primary Ballot over voting requirements

Two Republican candidates removed from May Primary Ballot over voting requirements

Plymouth School Board meeting Tuesday evening at 6

Plymouth School Board meeting Tuesday evening at 6

Chicago woman arrested on drug charge after traffic stop

Chicago woman arrested on drug charge after traffic stop

Man killed in Fulton County hunting accident

Man killed in Fulton County hunting accident