Lawrence County has been issued a tenative property assessment equalization factor of 1.000 according to the Illinois Department of Revenue.

The factor is often called the "multiplier". It is the method used to achieve uniform property assessments among counties, as required by law. State law requires property in Illinois to be assessed at 1/3 of its market value. Farm property in Illinois is assessed differently. Assessments here in Lawrence County at at 33.74% of market values, based on sales of properties in 2020, 2021 and 2022.

The factor currently being assigned to Lawrence County is for 2023 taxes payable in 2024. Last year, the equalization factor for the county was also 1.000.

Arbuckle notches 1000th career point in Saluki win

Arbuckle notches 1000th career point in Saluki win

New work requirements for Illinois SNAP

New work requirements for Illinois SNAP

Missing Vincennes juvenile being sought

Missing Vincennes juvenile being sought

Bridgeport man charged in fatal shooting

Bridgeport man charged in fatal shooting

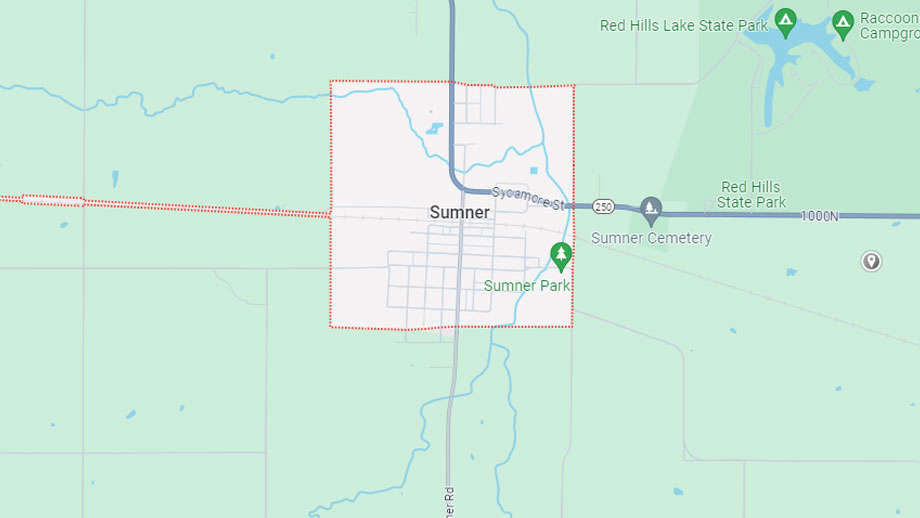

Lawrence County Historical Society planning Sumner history presentation

Lawrence County Historical Society planning Sumner history presentation

WGH Board approves expansion plans

WGH Board approves expansion plans

Lawrenceville mayor praises city workers

Lawrenceville mayor praises city workers

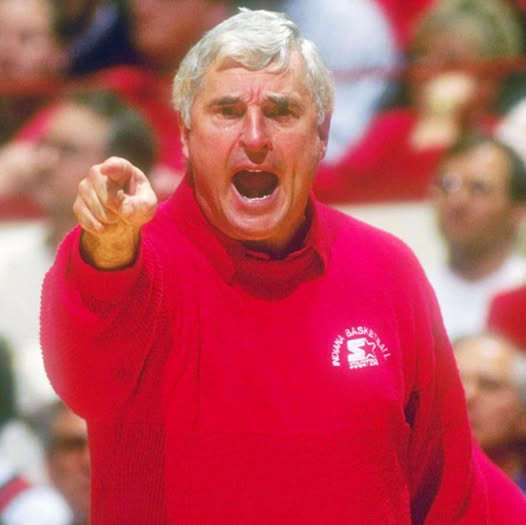

Road renaming resolution co-authored by Criswell to honor Bobby Knight passes House

Road renaming resolution co-authored by Criswell to honor Bobby Knight passes House

Lawrence County seek new Animal Control Warden

Lawrence County seek new Animal Control Warden

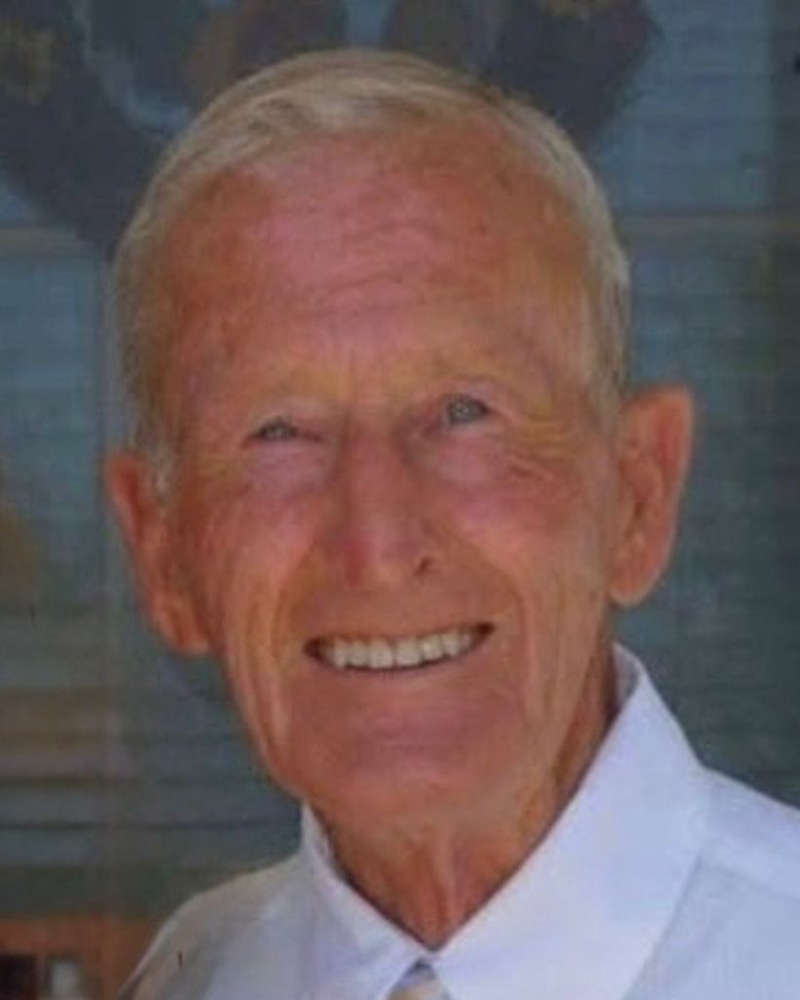

Lawrence County mourns the loss of Charlie Gillespie

Lawrence County mourns the loss of Charlie Gillespie

Illinois State Fair announces digital ticketing for 2026 season

Illinois State Fair announces digital ticketing for 2026 season

Home heating warnings

Home heating warnings

Lawrence County arrests

Lawrence County arrests

Knox County under Red Travel Warning

Knox County under Red Travel Warning

Another cold weather advisory issued

Another cold weather advisory issued

Winter storm hits region hard

Winter storm hits region hard

Knox County drug bust

Knox County drug bust

Winter storm warning issued for area

Winter storm warning issued for area

Winter storm watch in effect for area

Winter storm watch in effect for area

Unit #20 Board of Education recognizes Lady Braves and heroic students

Unit #20 Board of Education recognizes Lady Braves and heroic students