Lawrence County has been issued a tenative property assessment equalization factor of 1.000 according to the Illinois Department of Revenue.

The factor is often called the "multiplier". It is the method used to achieve uniform property assessments among counties, as required by law. State law requires property in Illinois to be assessed at 1/3 of its market value. Farm property in Illinois is assessed differently. Assessments here in Lawrence County at at 33.74% of market values, based on sales of properties in 2020, 2021 and 2022.

The factor currently being assigned to Lawrence County is for 2023 taxes payable in 2024. Last year, the equalization factor for the county was also 1.000.

One week left to file for office in Indiana

One week left to file for office in Indiana

Russiaville man arrested on active arrest warrants, narcotics

Russiaville man arrested on active arrest warrants, narcotics

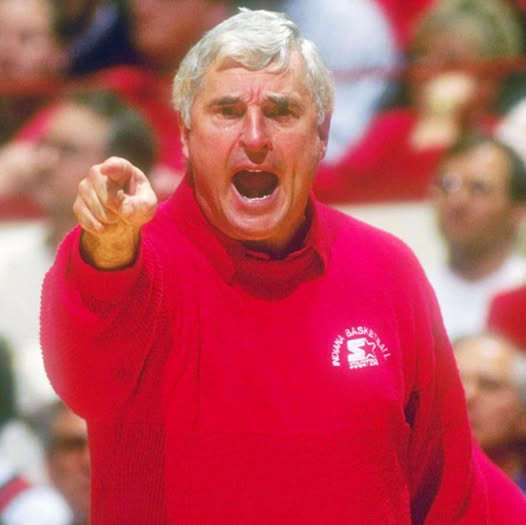

Road renaming resolution co-authored by Criswell to honor Bobby Knight passes House

Road renaming resolution co-authored by Criswell to honor Bobby Knight passes House

Goshen Health announces Letter of Intent to partner with Parkview Health

Goshen Health announces Letter of Intent to partner with Parkview Health

World Food Championships set for 2026 Indianapolis return

World Food Championships set for 2026 Indianapolis return

Attorney named Howard County judge by Gov. Braun

Attorney named Howard County judge by Gov. Braun

President Donald J. Trump approves emergency declaration for Indiana

President Donald J. Trump approves emergency declaration for Indiana

IDHS activates State Emergency Operations Center in response to winter storm

IDHS activates State Emergency Operations Center in response to winter storm