As Hoosiers begin filing their taxes, they will start to see bigger paychecks, larger refunds, and expanded opportunities to build long-term financial security because President Trump and Congressional Republicans passed the Working Families Tax Cuts.

“The Working Families Tax Cuts were designed to deliver real relief for Hoosiers and families across the country,” Rep. Yakym said. “By eliminating taxes on tips and overtime, expanding deductions for seniors, permanently doubling the standard deduction, and investing in the next generation through Trump Accounts, this legislation puts more money back into Hoosiers’ pockets. Families will see meaningful tax relief, stronger paychecks, and greater financial stability.”

KEY ELEMENTS OF THE WORKING FAMILIES TAX CUTS BELOW:

BIGGER TAX REFUNDS IN 2026

Americans will see historic refund levels this tax season:

- Nearly $4,000 average tax refund

- $100 BILLION in total tax refunds projected nationwide

- Refund levels among the highest in years

- 66% of the WFTC’s tax cuts benefit families earning less than $500,000

MORE MONEY IN EVERY PAYCHECK

Tax relief is boosting take-home pay all year long:

- Over $10,000 more in annual take-home pay for working families

- 15% average tax cut for Americans earning $15,000–$80,000

- More than 94% of middle-income working families receive a tax cut

PERMANENT TAX RELIEF FOR WORKING FAMILIES

The Working Families Tax Cuts locks in long-term tax benefits:

- Standard deduction permanently doubled — used by 90% of American taxpayers

- Lower tax rates and brackets made permanent — locks in reduced rates from the Trump tax cuts

TRUMP ACCOUNTS: A STRONG FINANCIAL START FOR EVERY AMERICAN CHILD

The Working Families Tax Cuts also establishes Trump Accounts, giving every newborn American a financial foundation from day one.

WHAT FAMILIES RECEIVE

- $1,000 federal contribution for every American child born between January 1, 2025 – December 31, 2028

- Account is fully in the child’s name, and parents are custodians until age 18

- Families have the option to contribute up to $5,000 per year

WHAT $1,000 BECOMES OVER TIME

Even without additional contributions, long-term growth can provide:

- $6,000 by age 18

- $15,000 by age 27

- $243,000 by age 55

All from a one-time $1,000 federal investment.

Operation Upper Hand: More than 65 arrested on over 200 criminal charges

Operation Upper Hand: More than 65 arrested on over 200 criminal charges

Person identified for making threat to Lewis Cass

Person identified for making threat to Lewis Cass

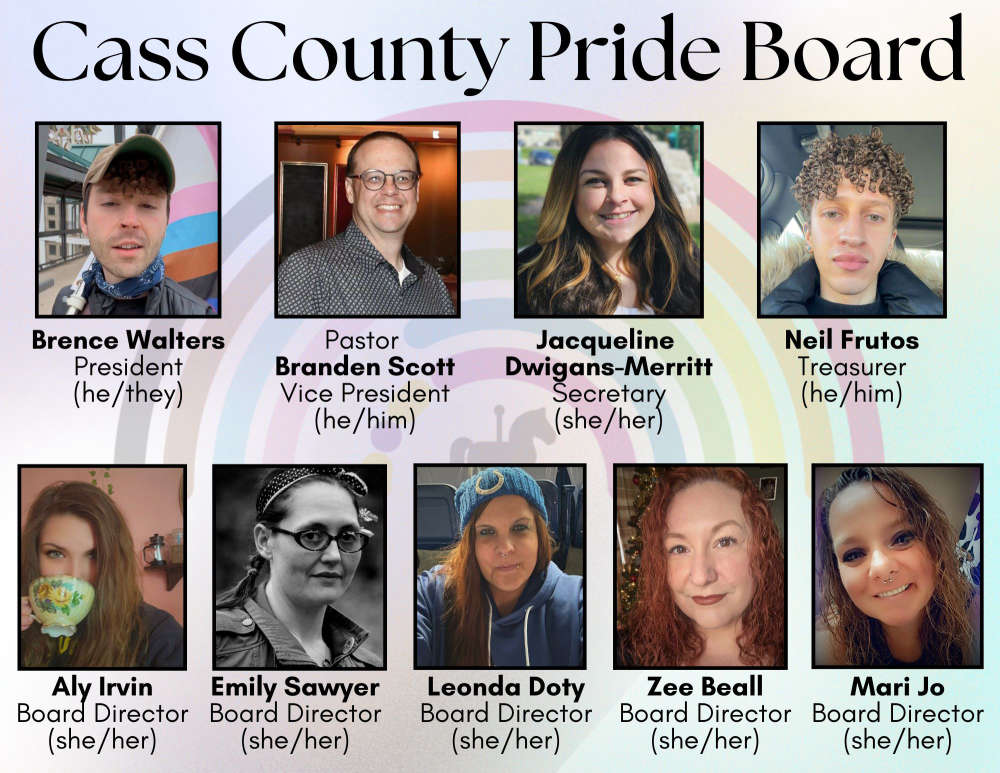

Cass County Pride announces new board members during annual meeting

Cass County Pride announces new board members during annual meeting

Friday is National Wear Red Day

Friday is National Wear Red Day

4C Health highlighting success of Certified Community Behavioral Health Clinic

4C Health highlighting success of Certified Community Behavioral Health Clinic

Applications being accepted for the Residential Safe Room Program

Applications being accepted for the Residential Safe Room Program

Mentone man turns self in after warrant issued following cyber tip investigation

Mentone man turns self in after warrant issued following cyber tip investigation