On Monday evening, the Plymouth Common Council took the first step in the Tax Abatement process by passing resolutions for two local industries.

The resolutions declare that certain real estate is within an Economic Revitalization Area (ERA). The first was for Composite Technology Assemblies at 904 Markley Drive. Composite Technology Assemblies is a Plymouth-based manufacturing company that specializes in producing advanced composite assemblies for various industries. With a focus on precision engineering and quality craftsmanship, the company offers a range of composite solutions to meet the unique needs of its clients. They plan to invest $2,384,000 for new equipment.

The second resolution declares that the AK Industries property at 2055 PIDCO Drive is within an ERA for tax abatement purposes. AK Industries is a leading producer of fiberglass and polyethylene products for the wastewater industry. It manufactures and assembles large fiberglass lift stations for municipalities and small-capacity ejector basins for the residential market. It also manufactures a line of polyethylene septic tanks, sump pits, basins, and plumbing accessories.

AK Industries is seeking a tax abatement of $3.2 million for real property and $1 million for personal property. This project is estimated to create 10 new positions.

The city will conduct a public hearing on the two requests at their October 28th meeting at 6:30 p.m.

Fulton County votes to pause plans on data center development

Fulton County votes to pause plans on data center development

ISP protect Hoosier kids from online predators

ISP protect Hoosier kids from online predators

Indiana BMV to offer Disability Blackout plate

Indiana BMV to offer Disability Blackout plate

U.S. Postal Service to observe Presidents Day, Feb. 16

U.S. Postal Service to observe Presidents Day, Feb. 16

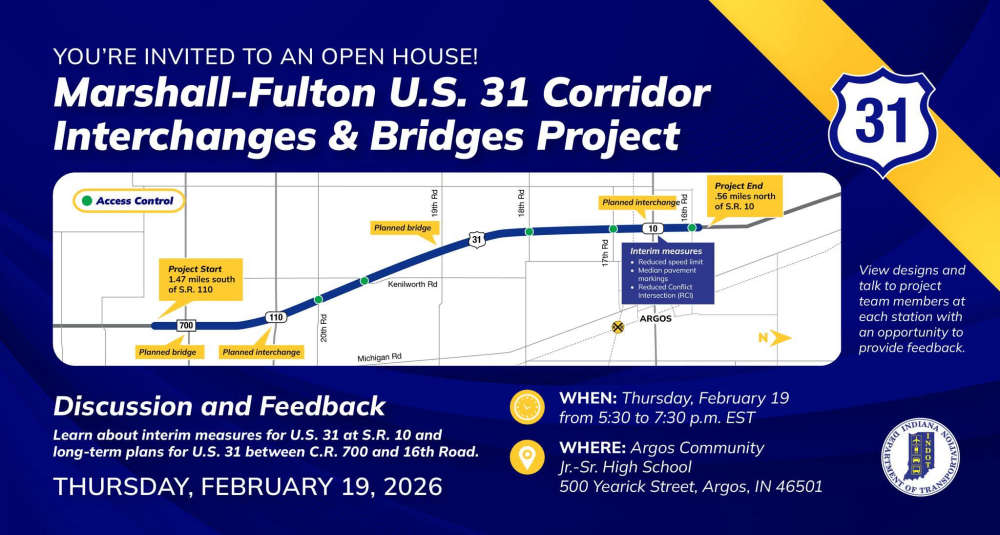

INDOT to hold open house regarding U.S. 31 improvements

INDOT to hold open house regarding U.S. 31 improvements

U.S. Representative Rudy Yakym meets with community members during Fulton County Legislative Breakfast in Akron

U.S. Representative Rudy Yakym meets with community members during Fulton County Legislative Breakfast in Akron

Indiana State Police Youth Camp dates for 2026

Indiana State Police Youth Camp dates for 2026

Dr. Aldridge transitioning to an independent medical provider

Dr. Aldridge transitioning to an independent medical provider